User Guide

Issuance and Wallets

Issuance and Wallets Overview

Capital Markets Platform provides for categorization of Tokens into various segments, enabling organization of tokenized securities with a similar structure to real-world assets. This topic summarizes how to create a Wallet in Capital Markets Platform, issue Tokens from a Wallet, and assign Tokens to a Transfer Agent.

To issue a Token in Capital Markets Platform, you must:

- Be logged in with an Issuer persona

- Have a Base Trade Wallet with sufficient funds

- Associate the Token with an Asset

- Apply a Tranche to the Asset

- Create a Counterparty to serve as the Issuer Name

Once the above process is complete, you can assign the Token to a TA (Transfer Agent).

Wallet Types

Info

The wallets serve as a function of the network you are on. Currently, Capital Markets Platform supports the Stellar and Ethereum networks. Capital Markets Platform can support other EVM compatible networks on request.

This topic describes the supported networks in DTCC Capital Markets Platform.

- System Wallet plays a role in activating new Brokerage wallets.

- Ethereum System Wallet pays the "gas fee" (the network fee required to successfully conduct a transaction or execute a contract) when issuing tokens on Ethereum.

- Base Trade Wallet is where minted tokens are stored. For Stellar, Base Trade Wallet transfers 15 XML to Issuing Wallet during token issuance. For EthereumSepolia, Base Trade Wallet transfers 0.1 ETH to Issuing Wallet during token issuance The Base Trade Wallet pays gas Fee when burning tokens.

- Issuing Wallet is created automatically when issuing a new token.

- An Issuing Wallet has 15 XLM for the Stellar blockchain. These funds are transferred from Base Trade Wallet.

- An Issuing Wallet has 0.1 ETH for EthereumSepolia. These funds are transferred from Base Trade Wallet.

- An Issuing Wallet pays "gas fees" when minting tokens.

- Issuing Wallet is an owner of a token issued in Stellar. A token is presented in a format Symbol.IssuingWallet. This wallet also signs transactions.

- An Issuing Wallet approves tokens issued in Ethereum. A token is presented in a format Symbol.SmartContracts. Issuing wallet signs transactions as well.

- Trust Line Wallet initiates setting a Trust Line that pays the associated "gas fee." For example, if a user sets a Trust Line on a Brokerage Wallet, the fee will be taken from the Brokerage Wallet.

Issuance Log On

Log in with credentials that have Issuer permissions.

Sample Login

Go to https://demo-brokerage.securrency.com/admin/login

User Name: sample.user@gmail.com

Password: Welcome123!

View Profiles (Issuer, TA, and Investor)

This topic describes how to view a user's profile within an entity or company. See User Profiles for a list and description of all DTCC Capital Markets Platform user profiles.

To view the user profiles for a specific entity:

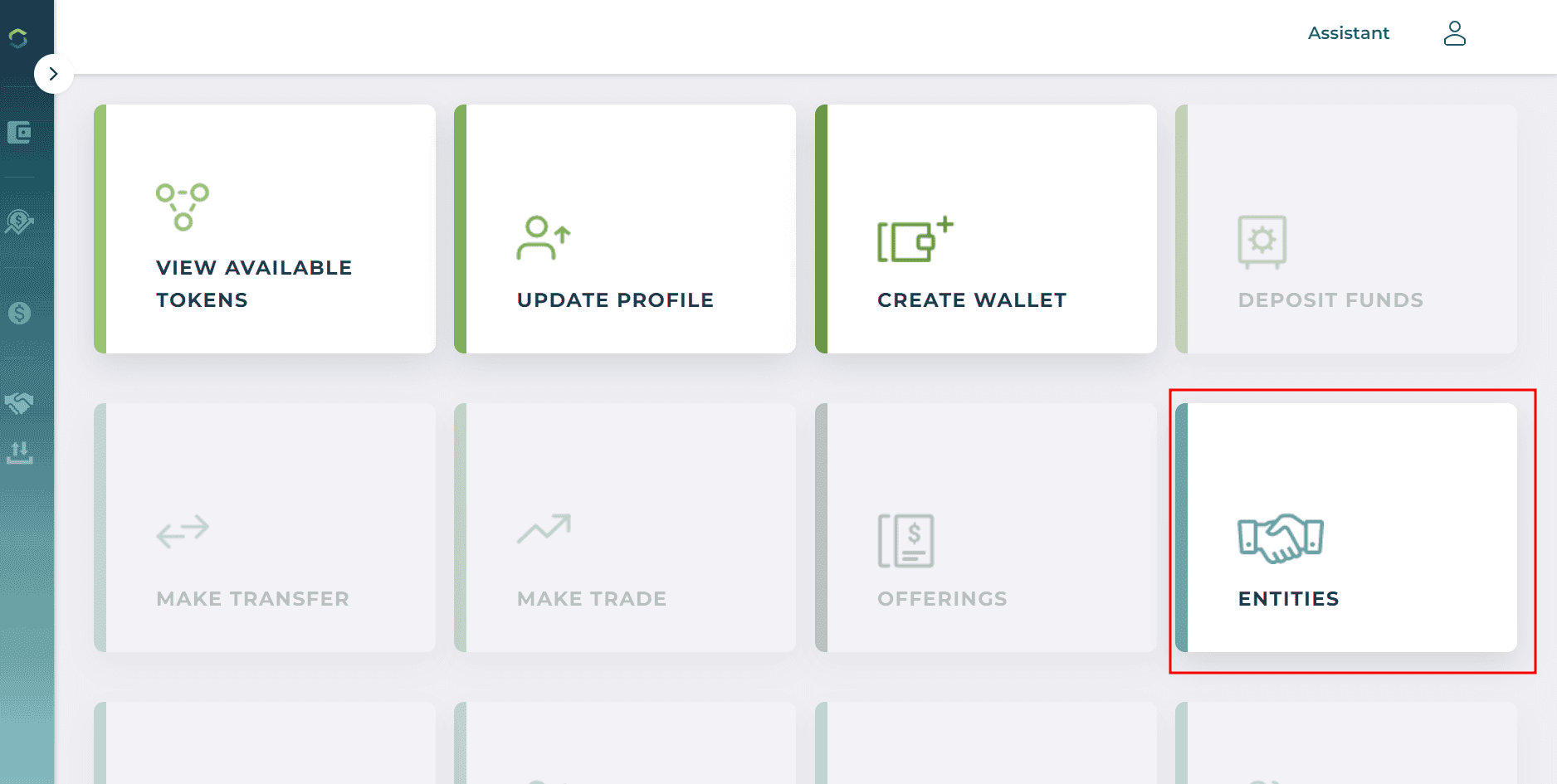

From the home dashboard, click the Entities tile

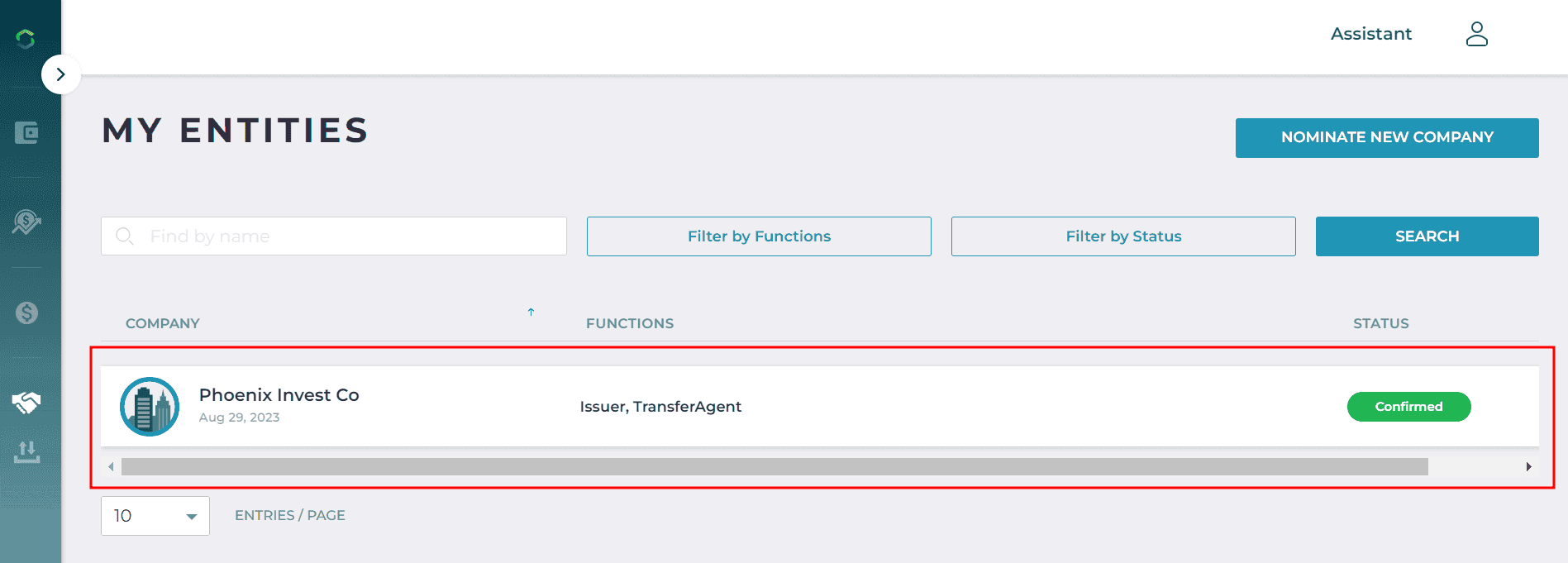

Click on the "Company"

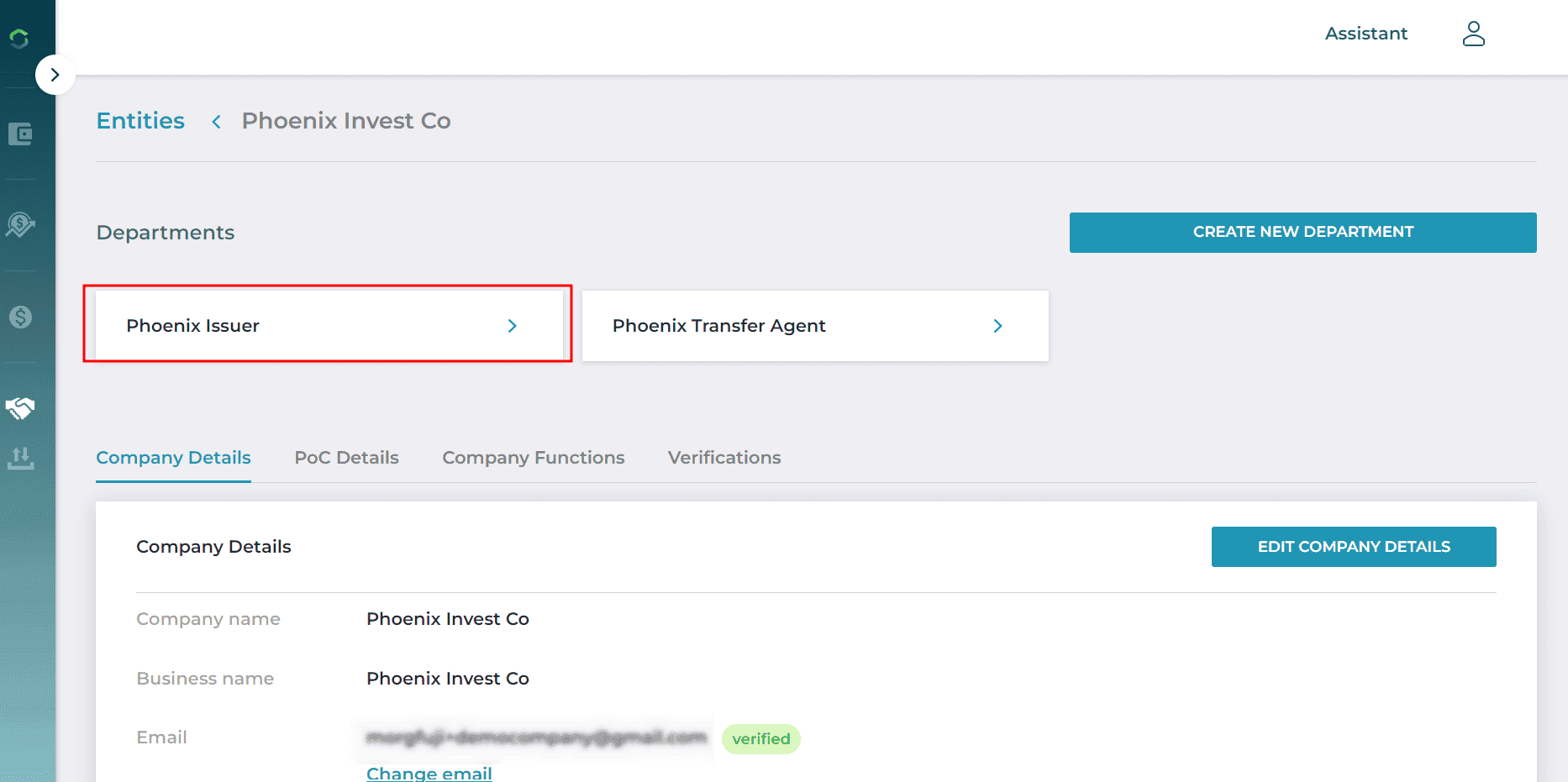

Click the Entity name (under Departments) to view the associated profiles

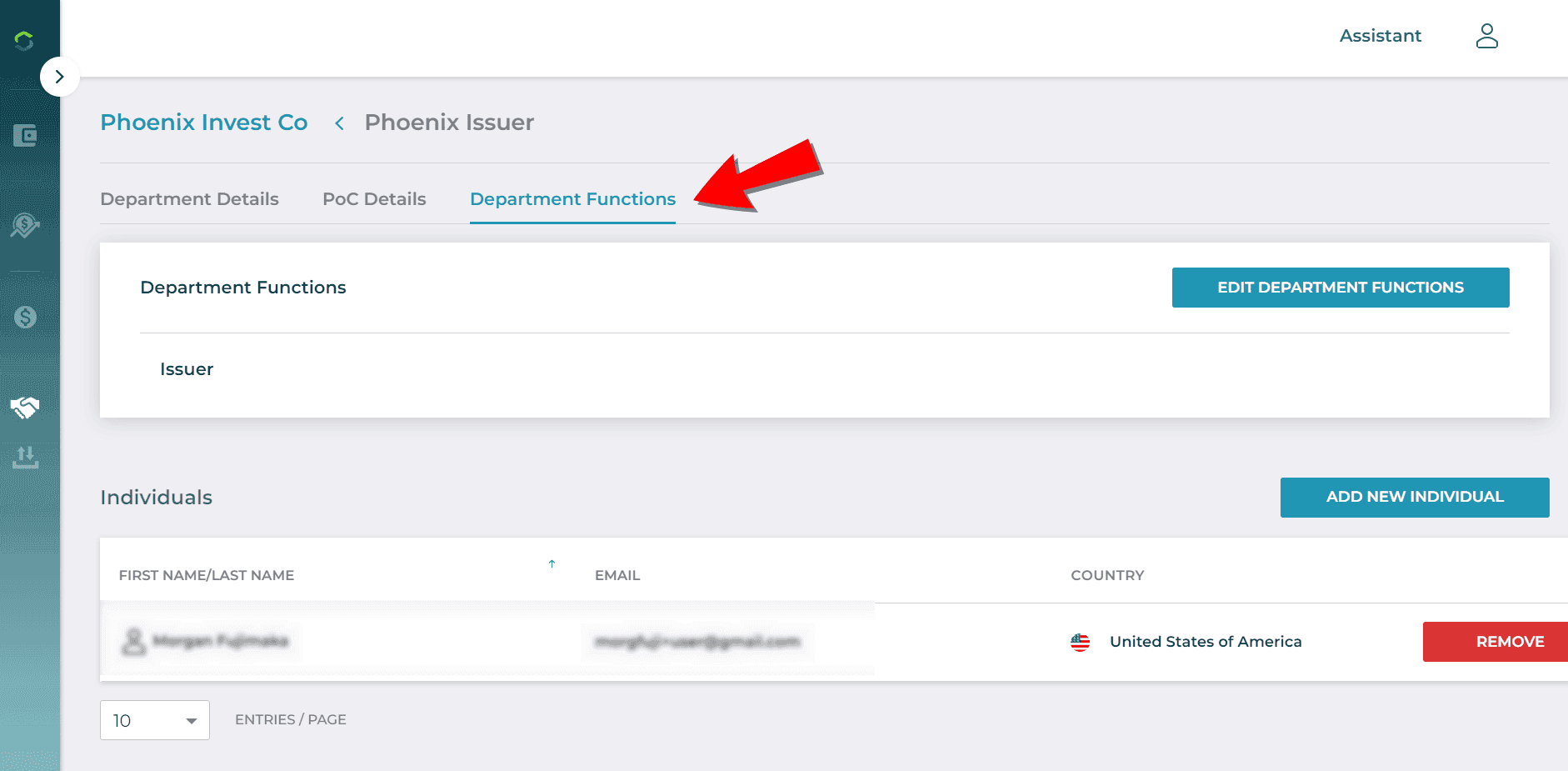

Click the Department Functions tab to see the user's profile functions

Create and Manage Wallet

This topic describes creation and management of Wallets. You can port the operational mechanism of your Wallet into Capital Markets Platform. See Wallet Types for a description of all Wallets that Capital Markets Platform accepts.

The following key principles apply to Wallets:

- All blockchain transactions are performed and issued through Wallets. If you are operating on the blockchain, you have a Wallet.

- DTCC Capital Markets Platform is blockchain agnostic and can incorporate virtually any blockchain.

- Wallets display transactions and securities. An issuer persona will be able to see the tokens that they issued in a wallet, as well as the Wallet holdings.

- Each blockchain is represented by a dedicated Wallet. Each blockchain has various advantages and disadvantages, depending on the type of transaction you want to execute.

Adding a Wallet

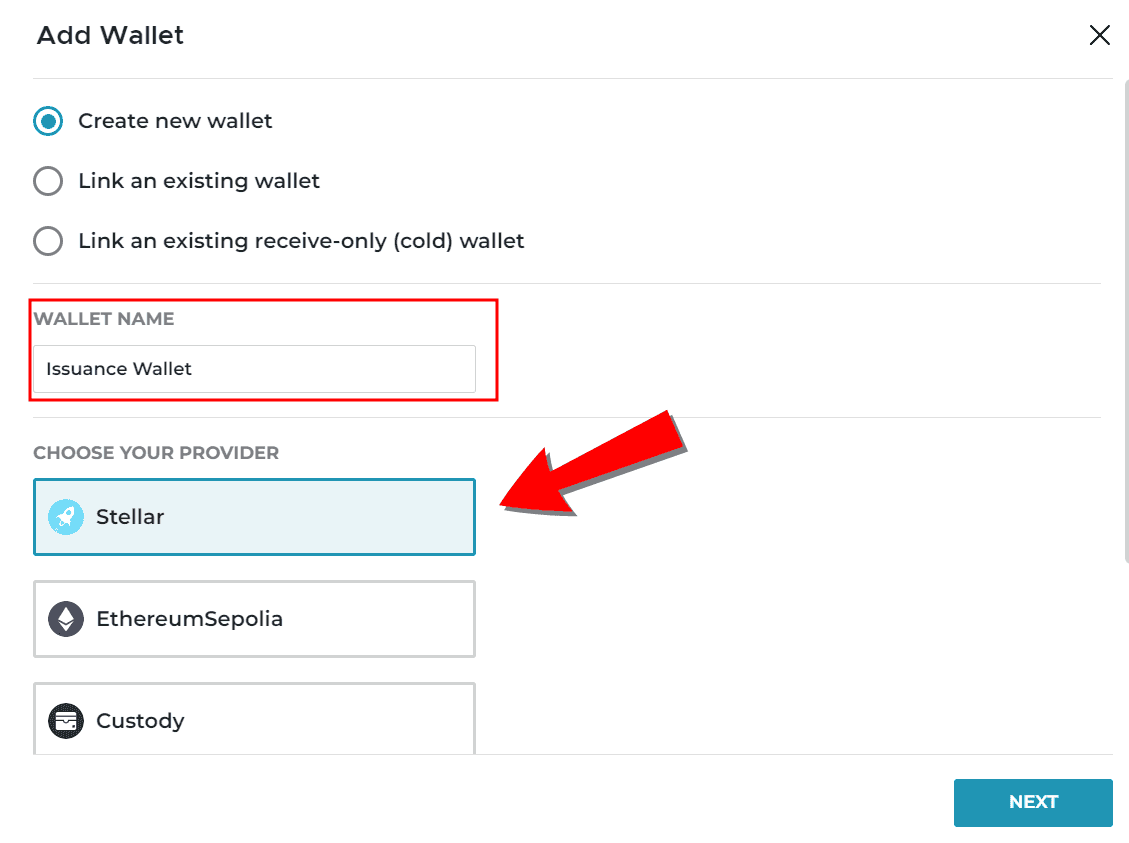

When adding a wallet to the Capital Markets Platform, you can choose from several options based on how you intend to use the wallet. The following outlines each available method:

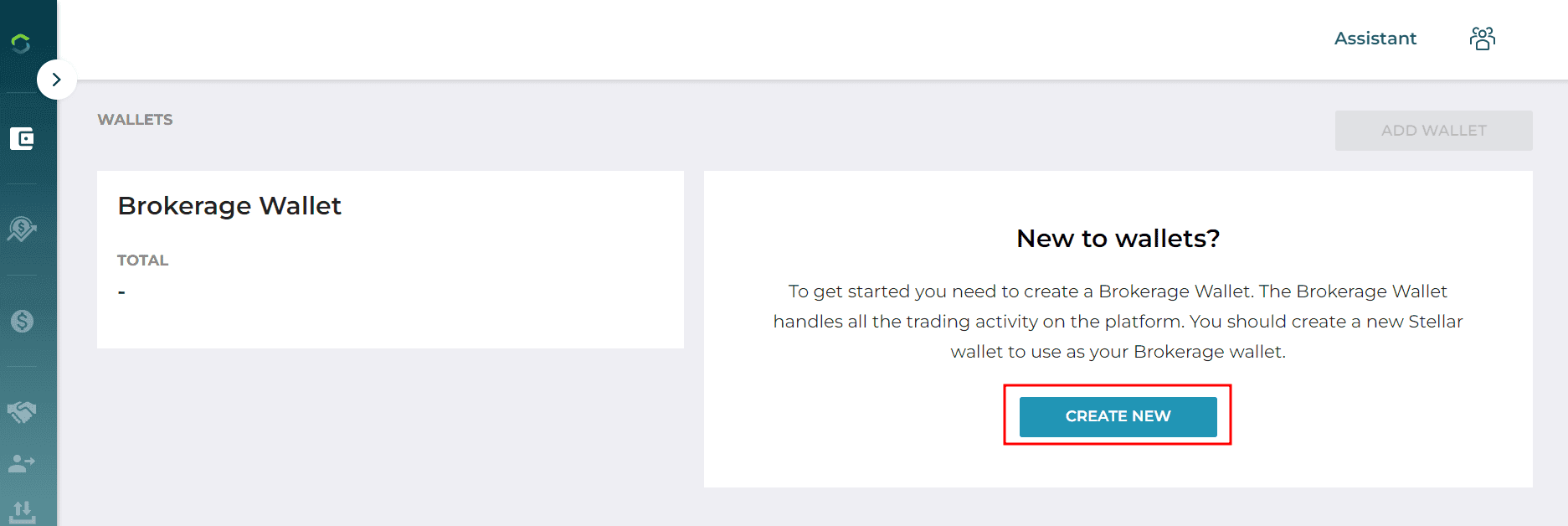

- Select Create New Wallet to create a new wallet on the selected blockchain and store the secret key in the Capital Markets Platform.

- Choose "Link an Existing Wallet" if you already have a wallet and want to use it on the Capital Markets Platform to manage transactions. Capital Markets Platform will ask for both the public and private key.

- You can make any wallet a Base Trade Wallet when you issue tokens.

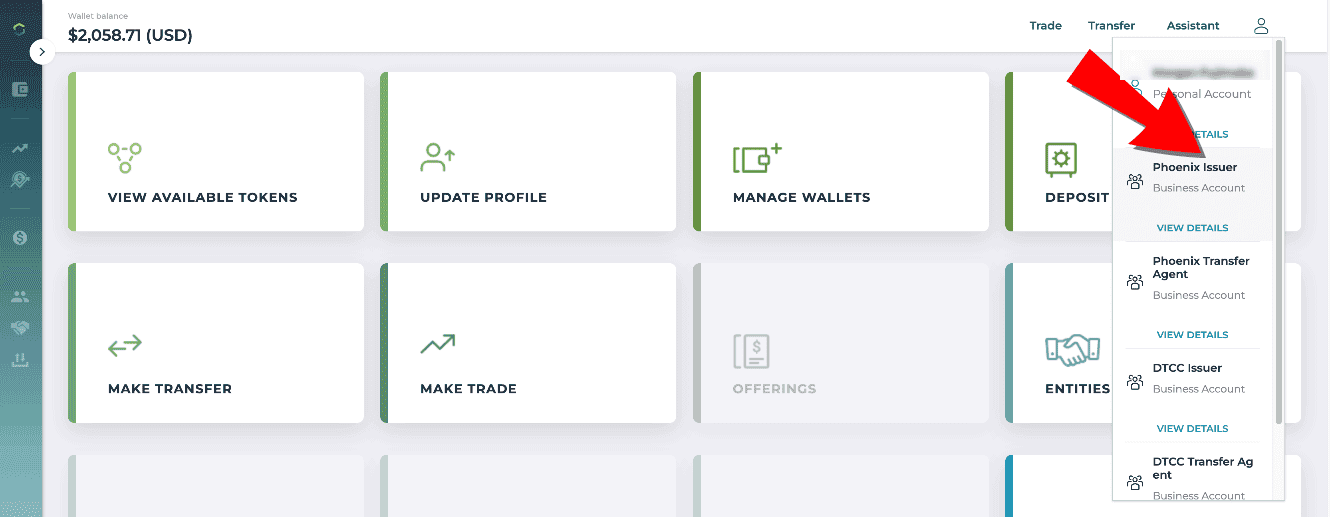

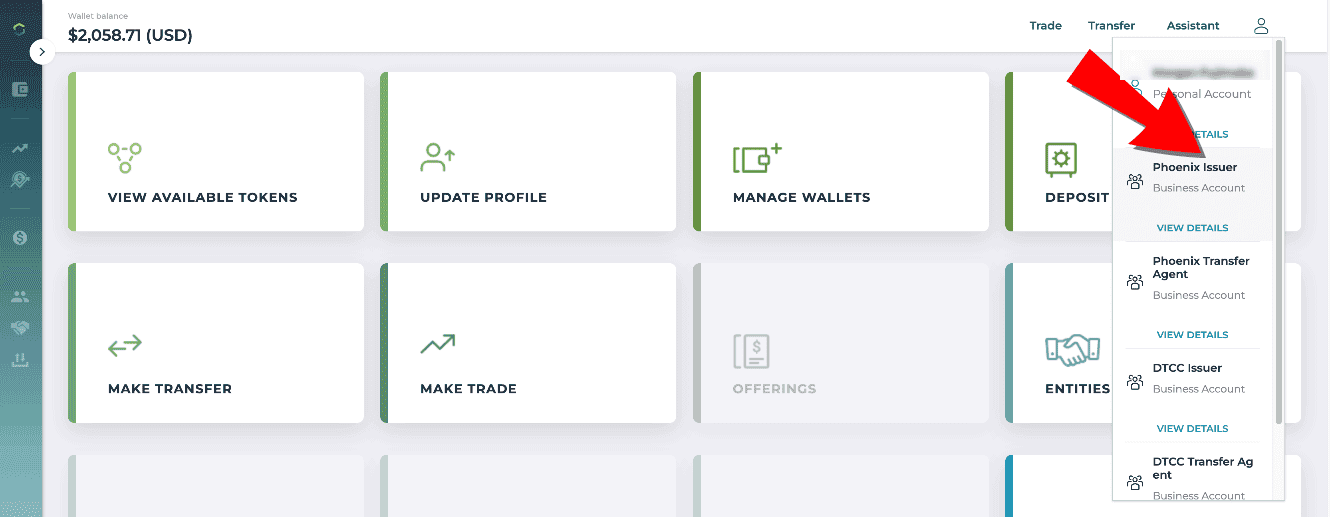

Select the Issuer profile that you want to create the new Wallet for. Note: the persona appears next to the profile name.

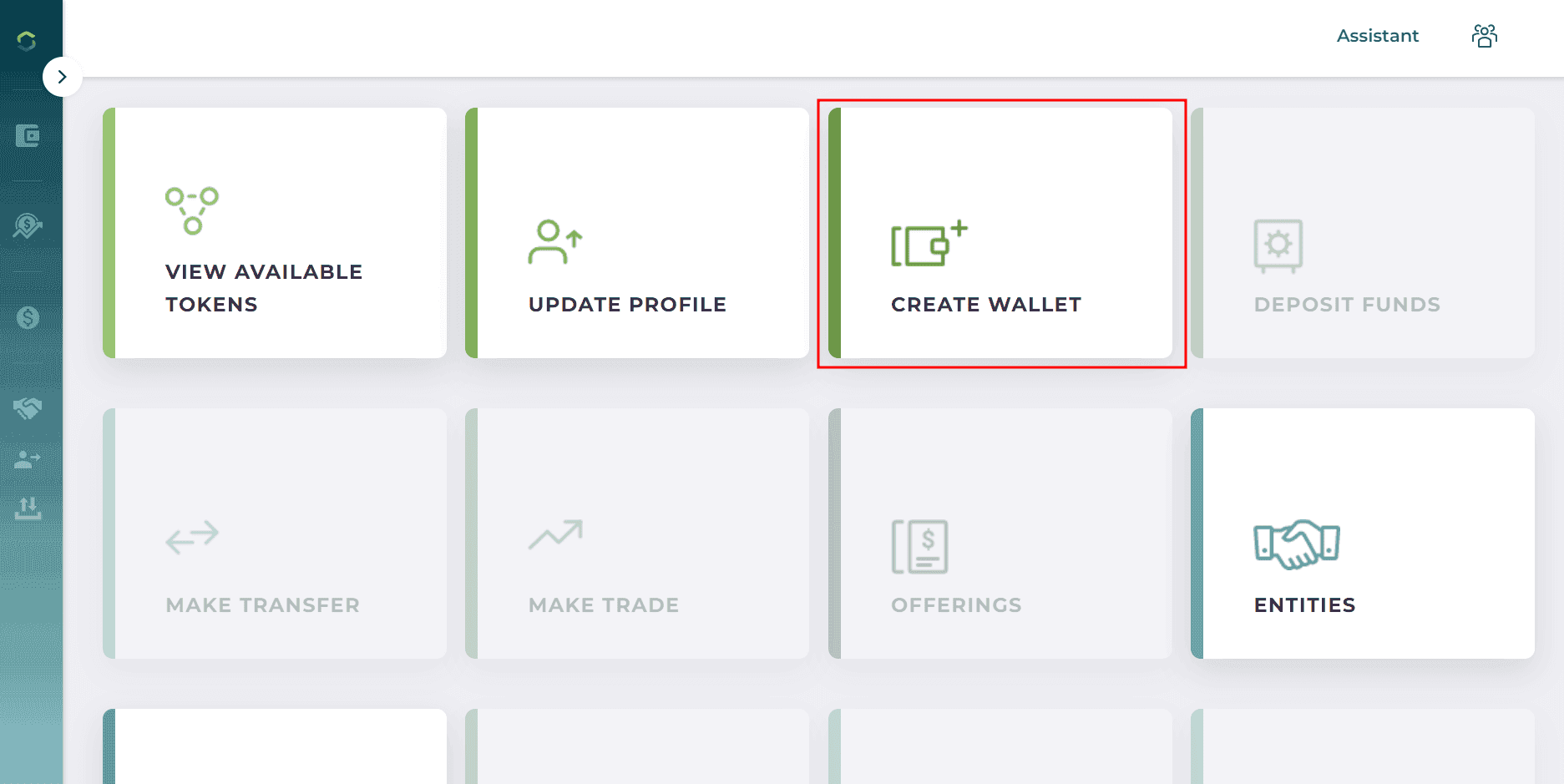

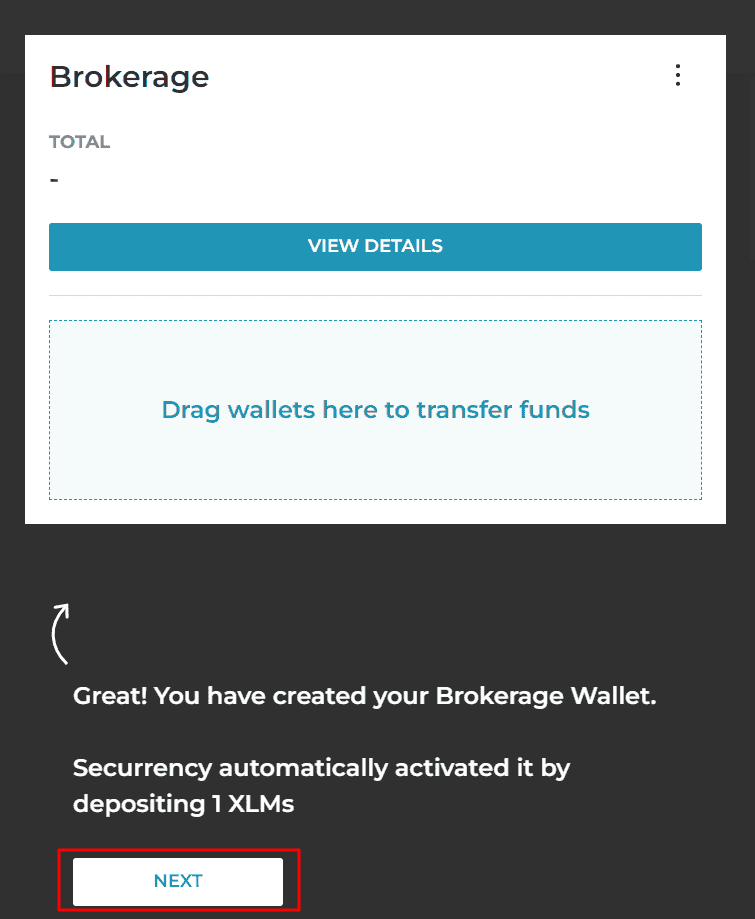

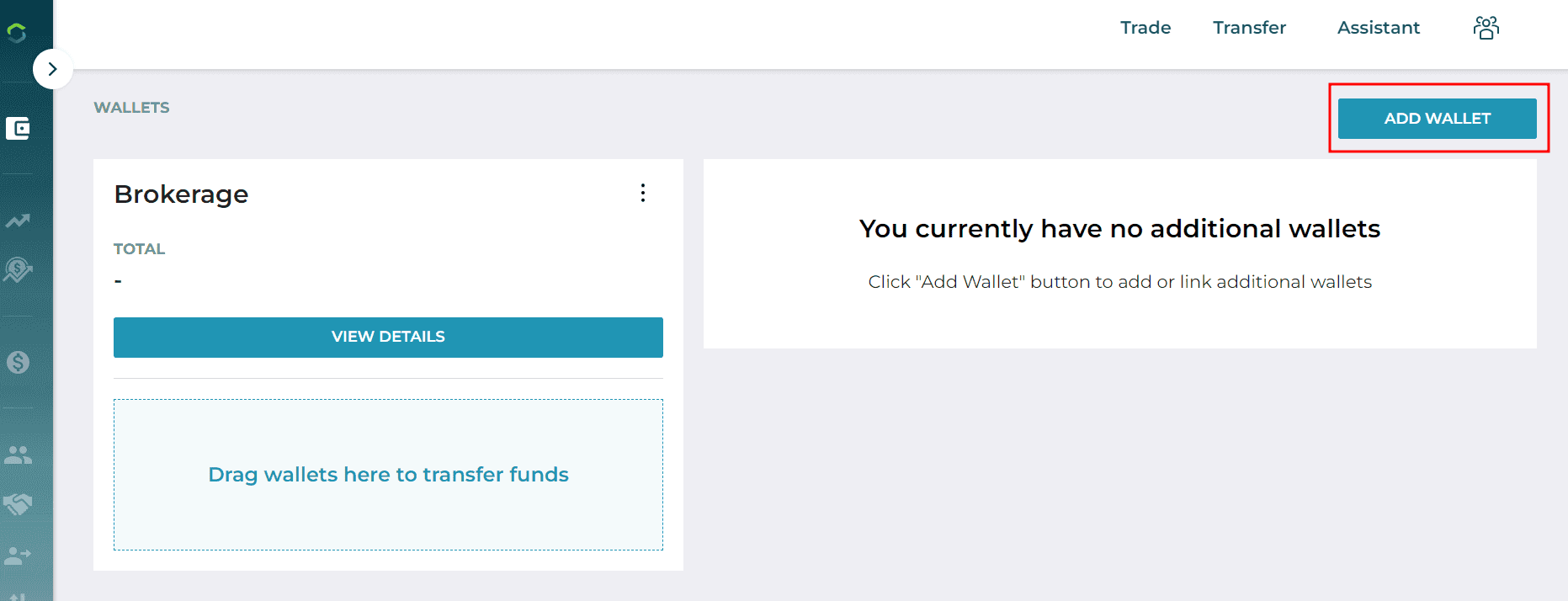

Click "Create Wallet" Note: If this is not your first Wallet, the Wallet tile displays Manage Wallets. Click Add Wallet in the upper right to create a new wallet.

Click "Create New"

Click "Next"

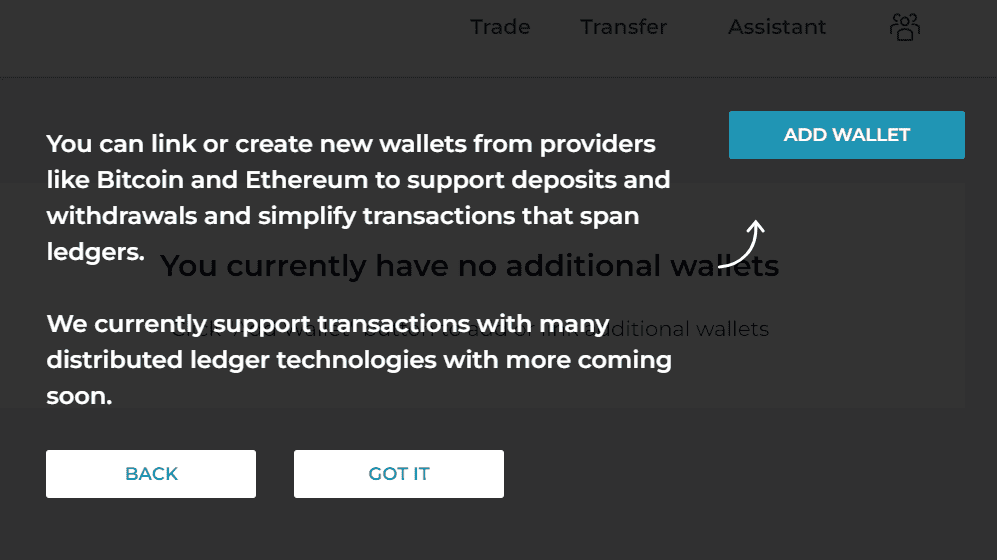

Click "GOT IT"

Click Add Wallet on the main Wallet menu

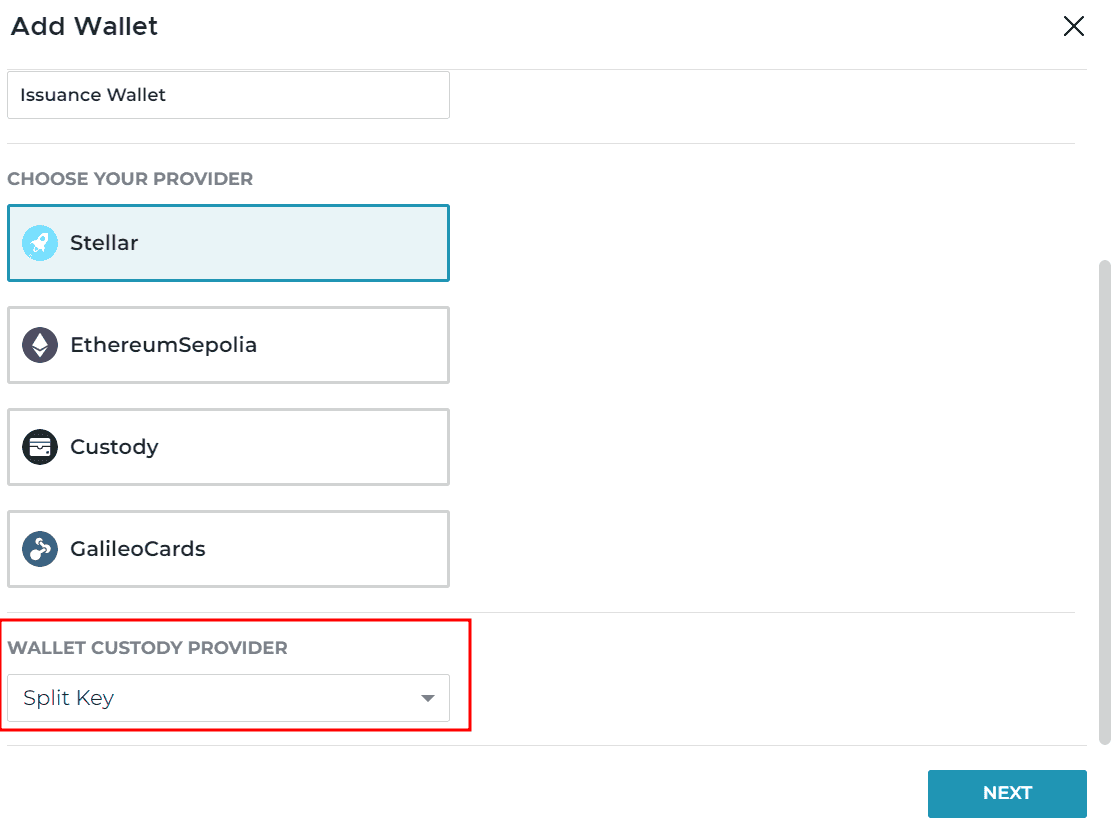

Complete the Wallet Name field (open text). Then select "Stellar"

From the Wallet Custody Provider dropdown, select Split Key Note: Custody and Galileo are not currently utilized by Capital Markets Platform.

You can create a Base Trade Wallet using the process above

Setup an Asset and Tranche

You can create Assets with multiple Tranches within Capital Markets Platform, enabling organization of tokenized securities with a similar structure to real-world assets. For example, a security normally has different structures that may include various share classes. DTCC Capital Markets Platform enables you to mimic these multi-tranche structures that exist in the real world.

Create an Asset

Select the Issuer profile for which you want create the new asset

Note: the persona is included next to the profile name.

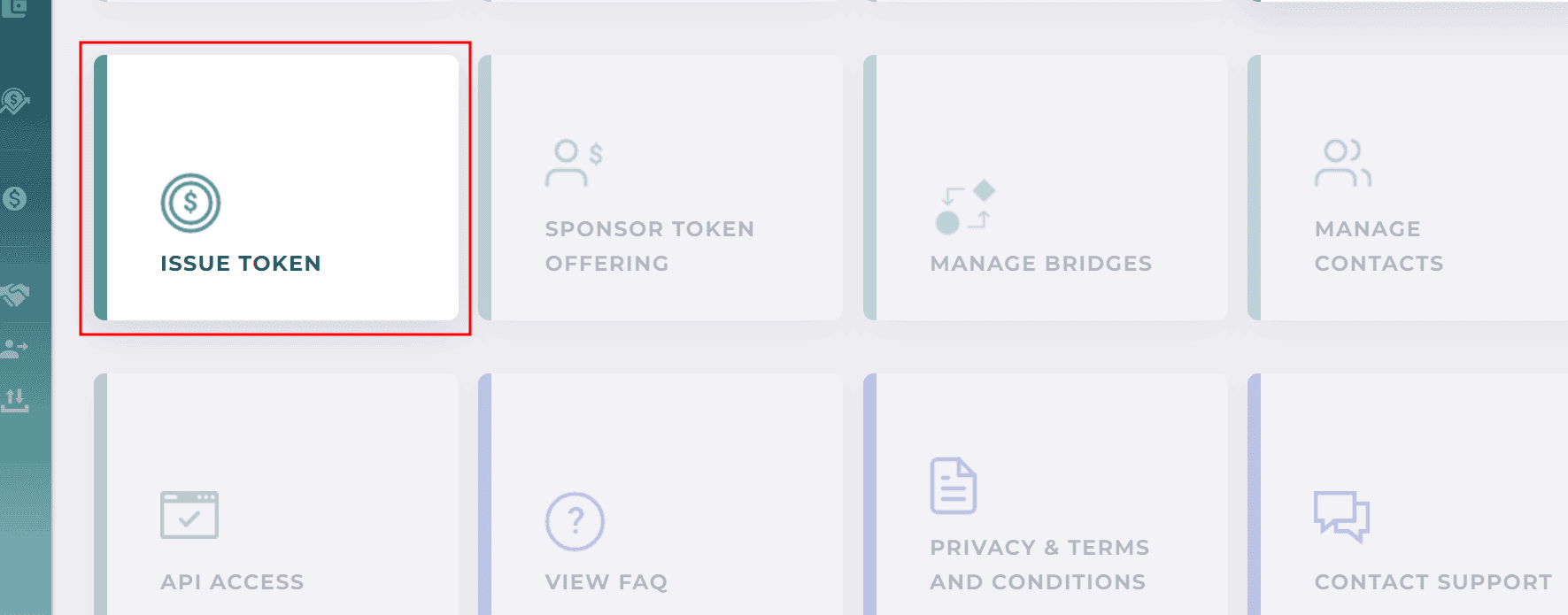

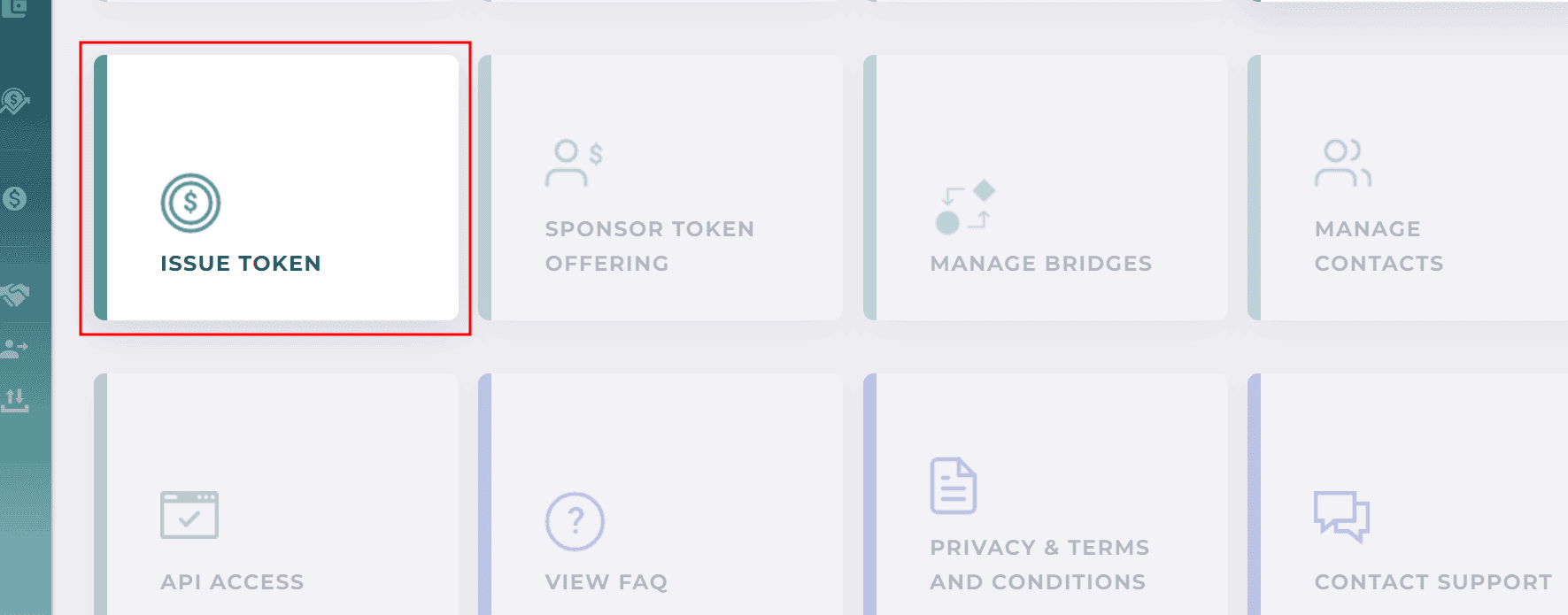

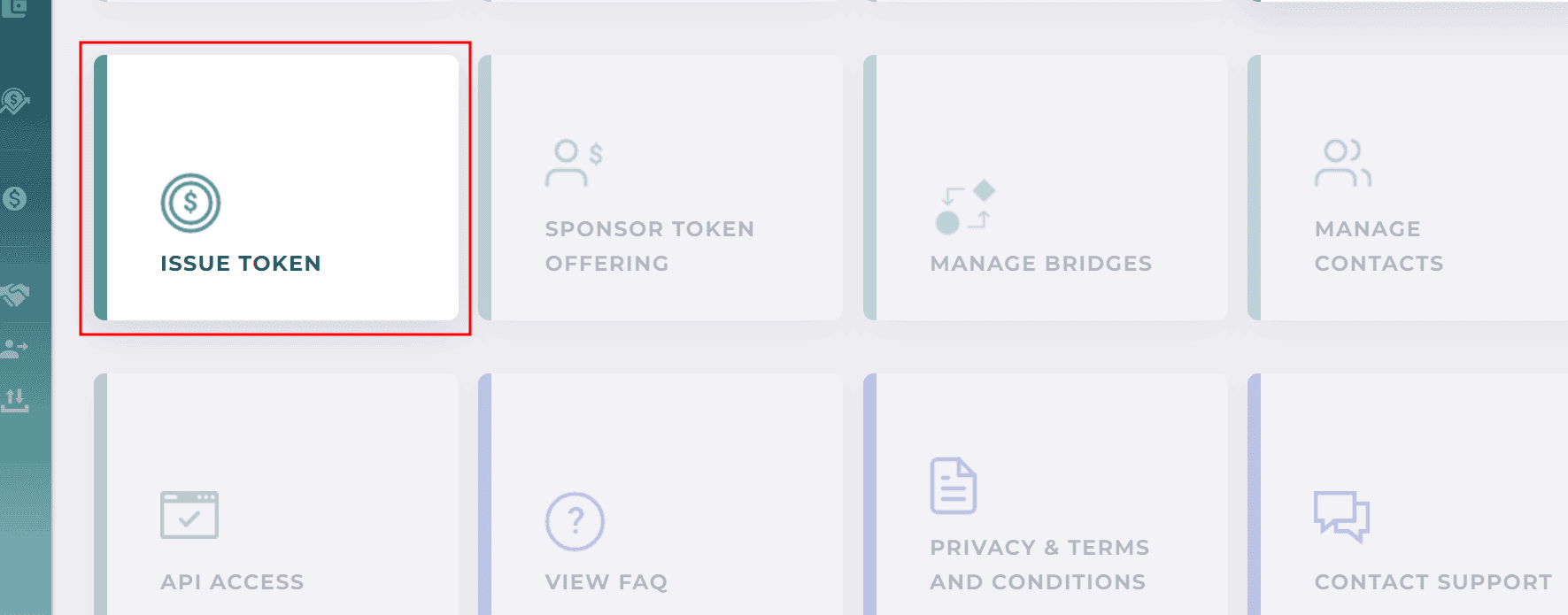

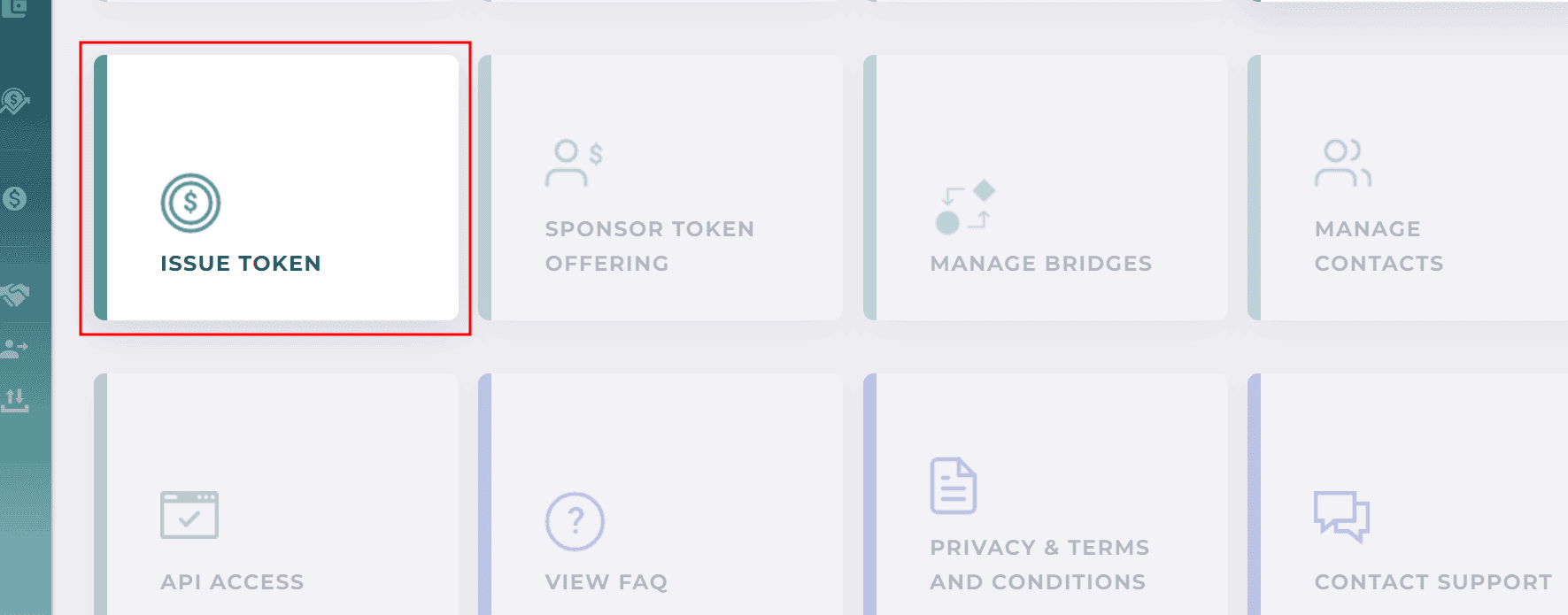

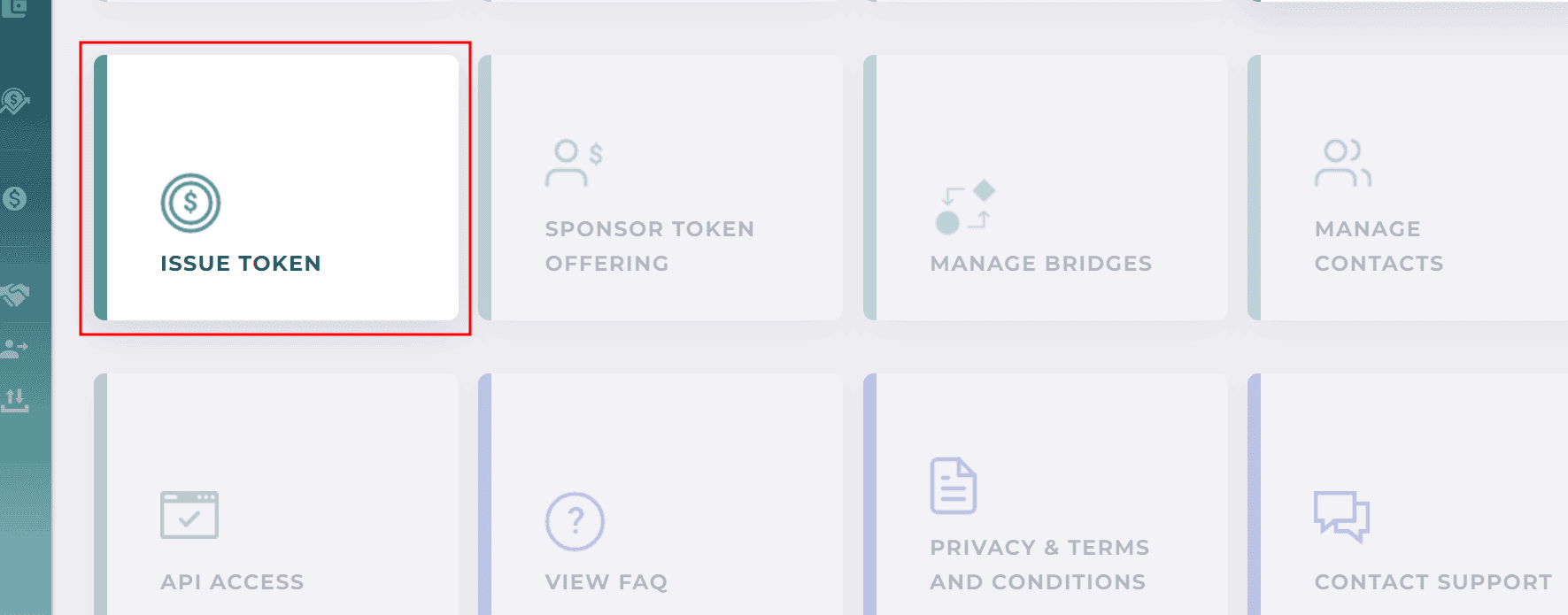

From the home dashboard, select "Issue Token"

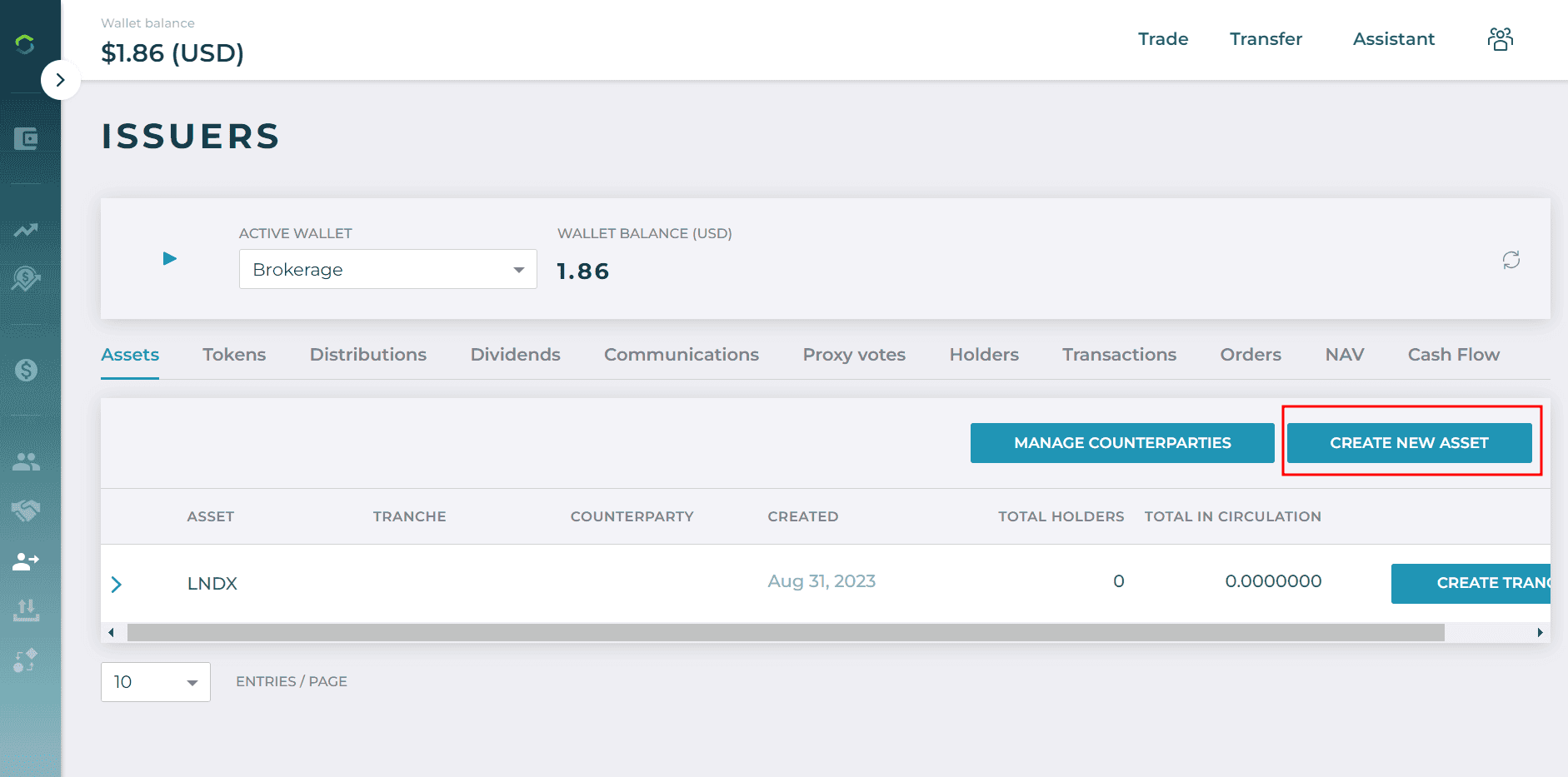

Click "Create New Asset"

Enter the asset name in the text field and click "Create"

Create a Tranche

Info

Creating an Asset and Tranche does not make any changes to the blockchain. See Issue Token for information on issuing a token from your created Assets and Tranches.

You can add multiple Tranches to an Asset, enabling:

- issuance of a multi-class asset

- asset distribution under different blockchains

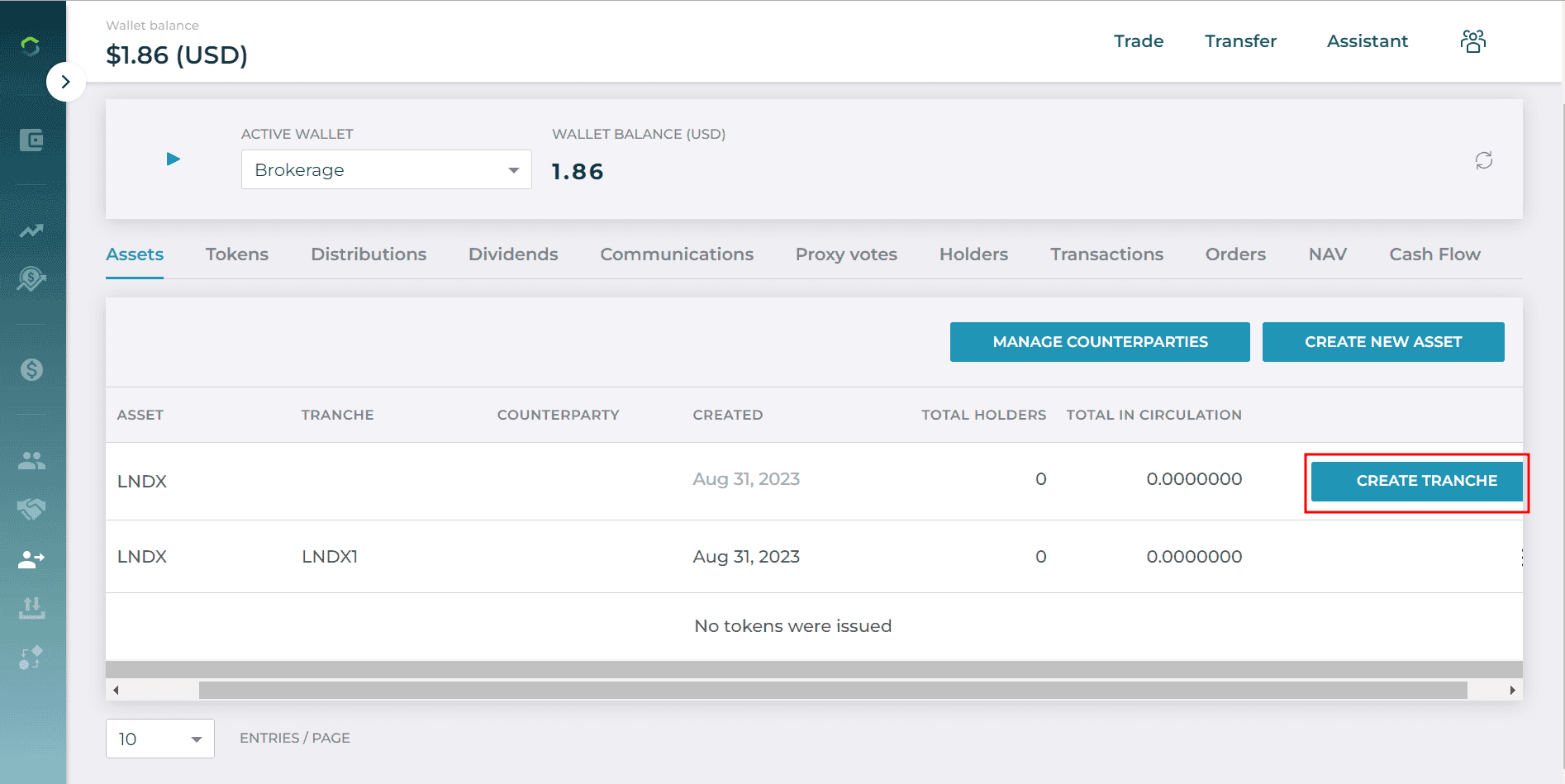

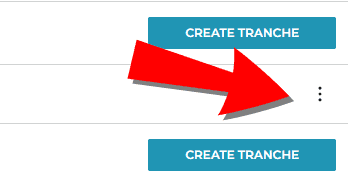

From the Asset menu, select the Asset under which you want you want to create a new Tranche, then click "Create Tranche"

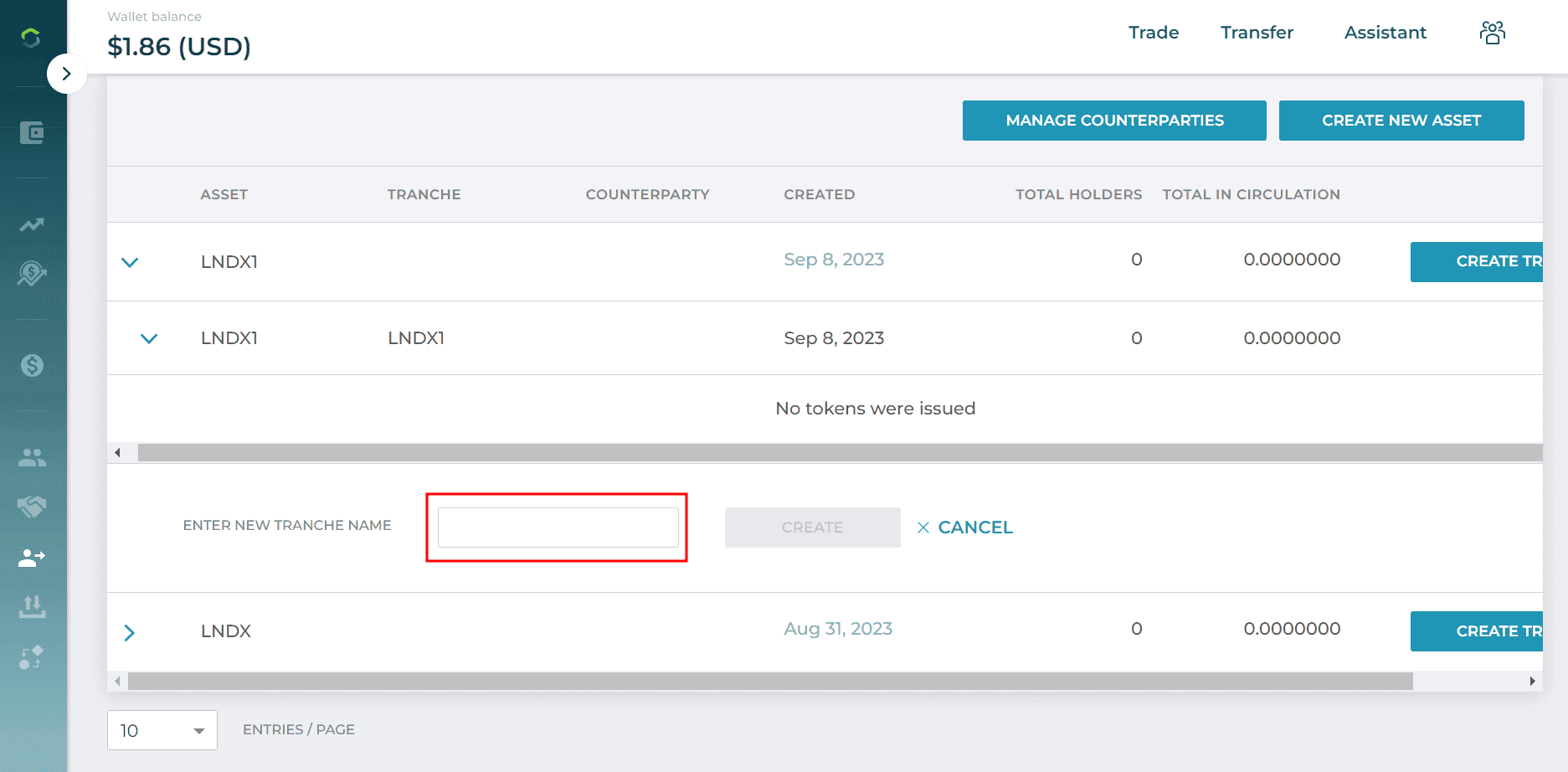

Enter the Tranche Name in the text field.

Counterparty Management

Counterparty Management provides a methodology to identify a Token based on the unique structure of your use case. It enables segregation of a Token that is under the same Asset name and Tranche.

Effective counterparty management is essential when issuing tokens on the Capital Markets Platform. Keep the following key points in mind:

- All issued tokens must be linked to a designated Counterparty.

- When issuing a token, it must originate from one of your created Counterparties, which will appear as the Issuer Name.

- The platform uses the following naming convention for tokens: “AssetName.Tranche.Counterparty.Provider.”

To add a Counterparty to an existing Token:

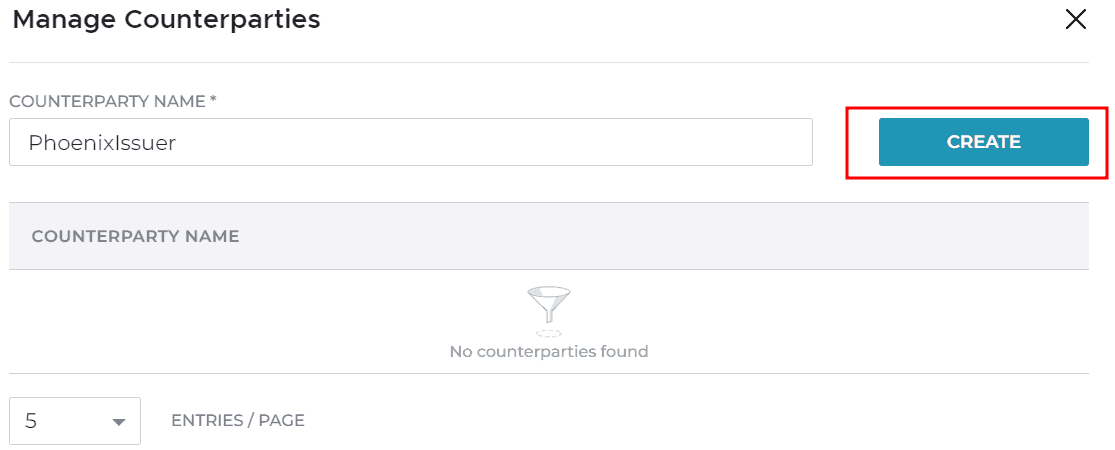

From the home dashboard, click on the Issue Token tile

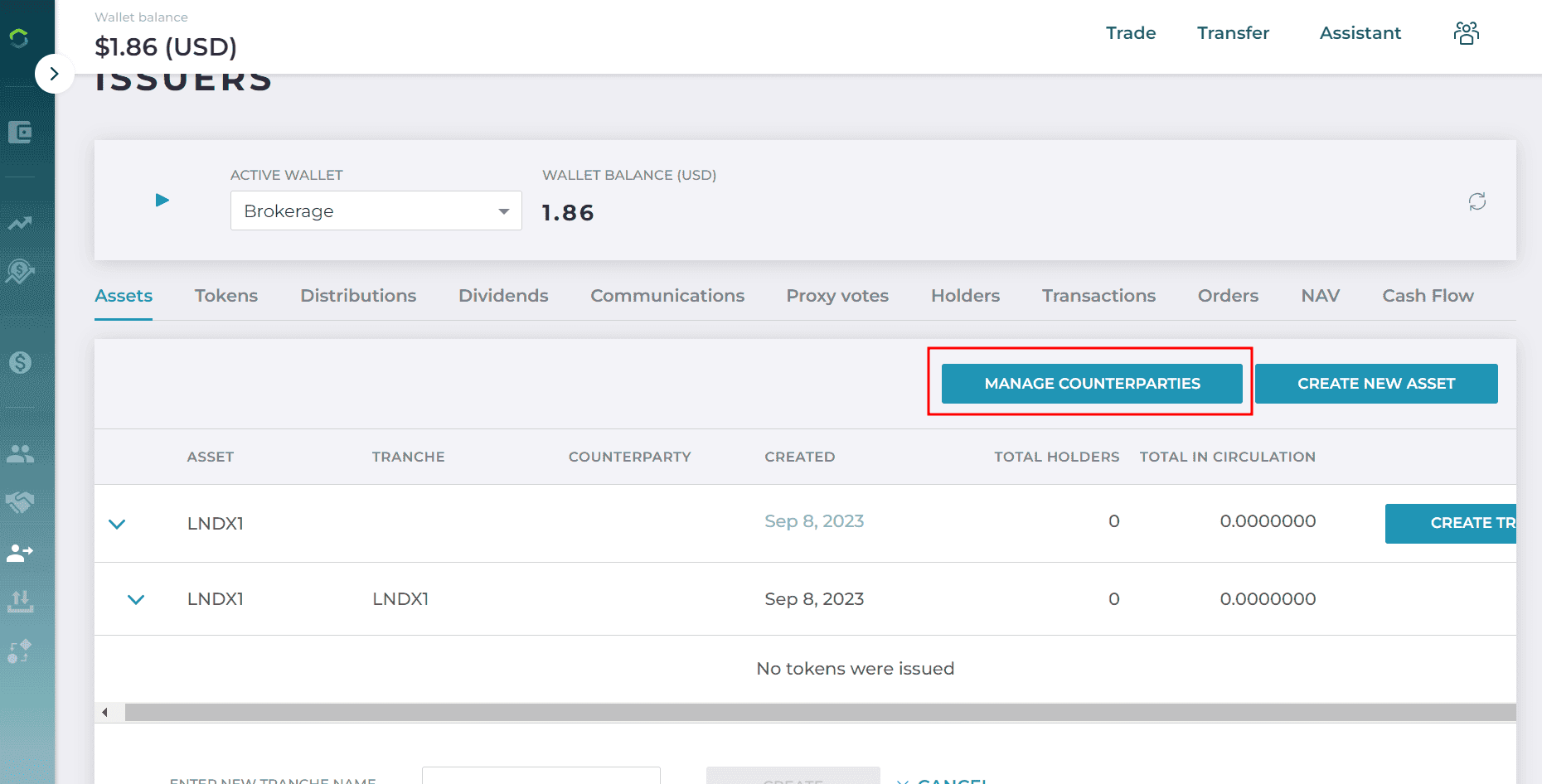

Click the "Manage Counterparties" button

Enter the Counterparty Name in the text field, then click "Create"

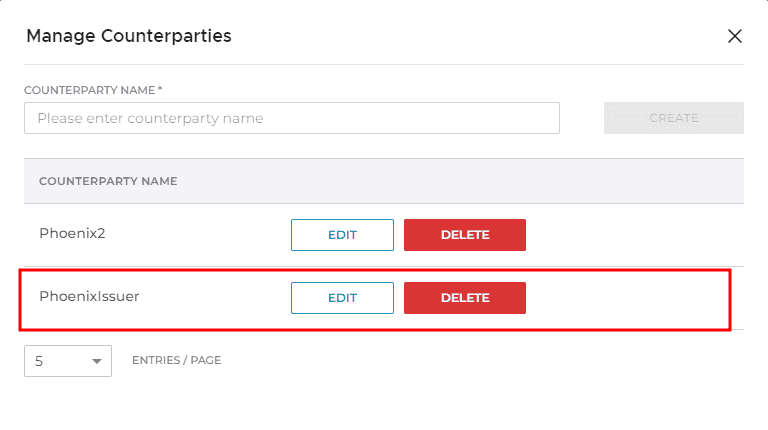

The new Counterparty name will display in the Manage Counterparties menu

Issue Token

This topic describes how an Issuer persona can issue a Token that is recorded onto the Blockchain.

Before issuing tokens on the Capital Markets Platform, ensure the following conditions are met to complete the process successfully:

- Tokens can only be issued from Assets that have established Tranches.

- Ensure the Base Trade Wallet has a sufficient token balance before initiating issuance. Note: The Base Trade Wallet is owned by the Issuer.

- To verify the wallet balance, identify the Base Trade Wallet for the token on the Token screen (make sure you are logged in as the Issuer). Once confirmed, check the token balance on the network in the Wallet section.

To issue a Token on the blockchain:

Click the Issue Token tile from the home dashboard

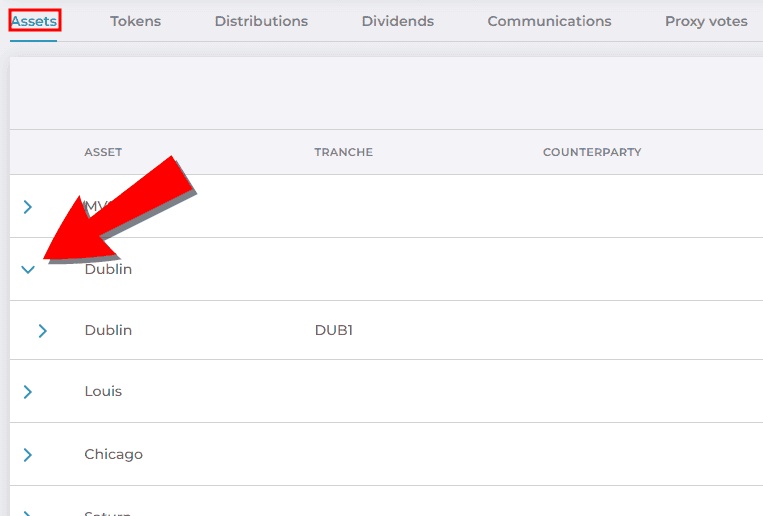

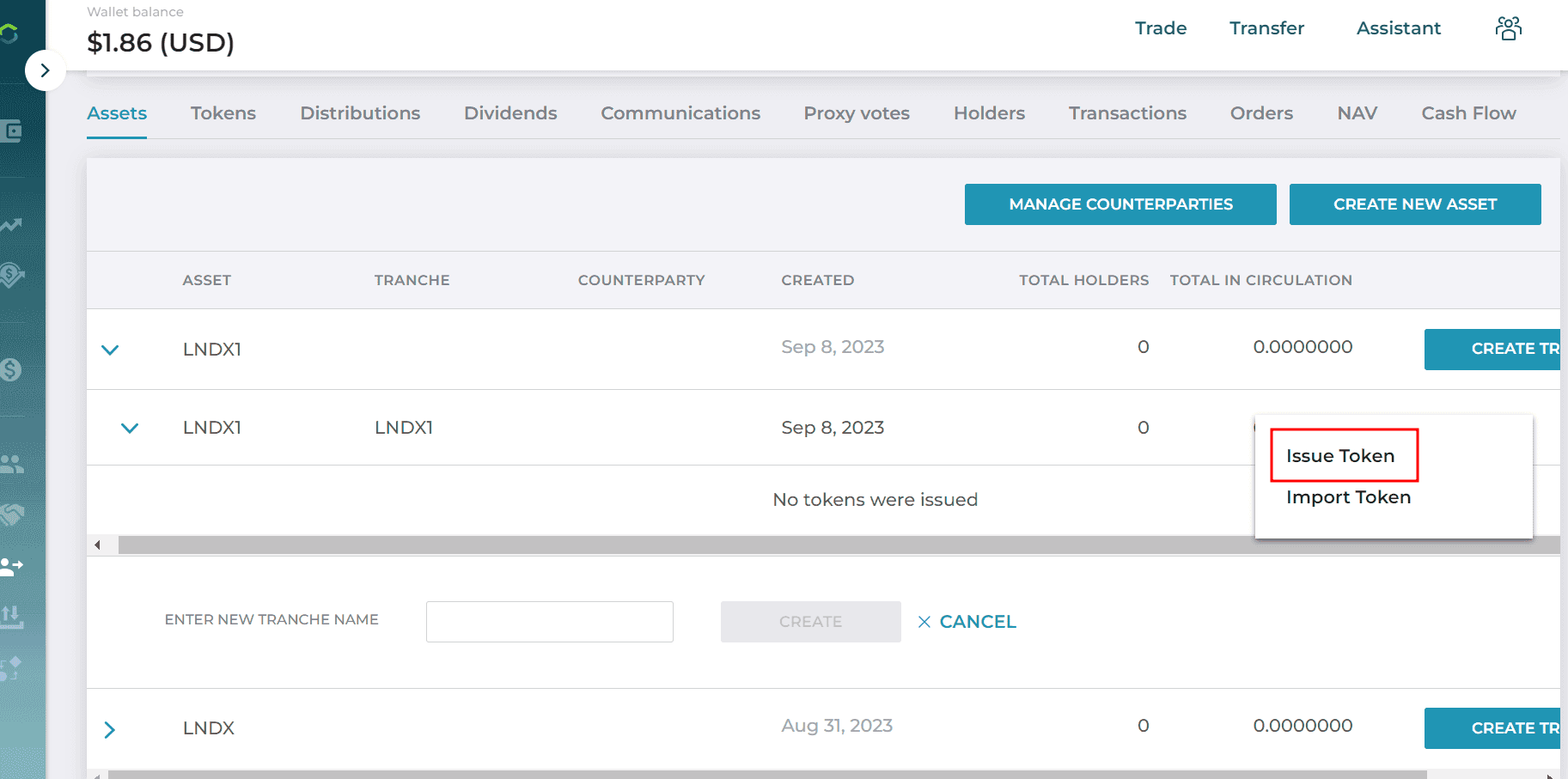

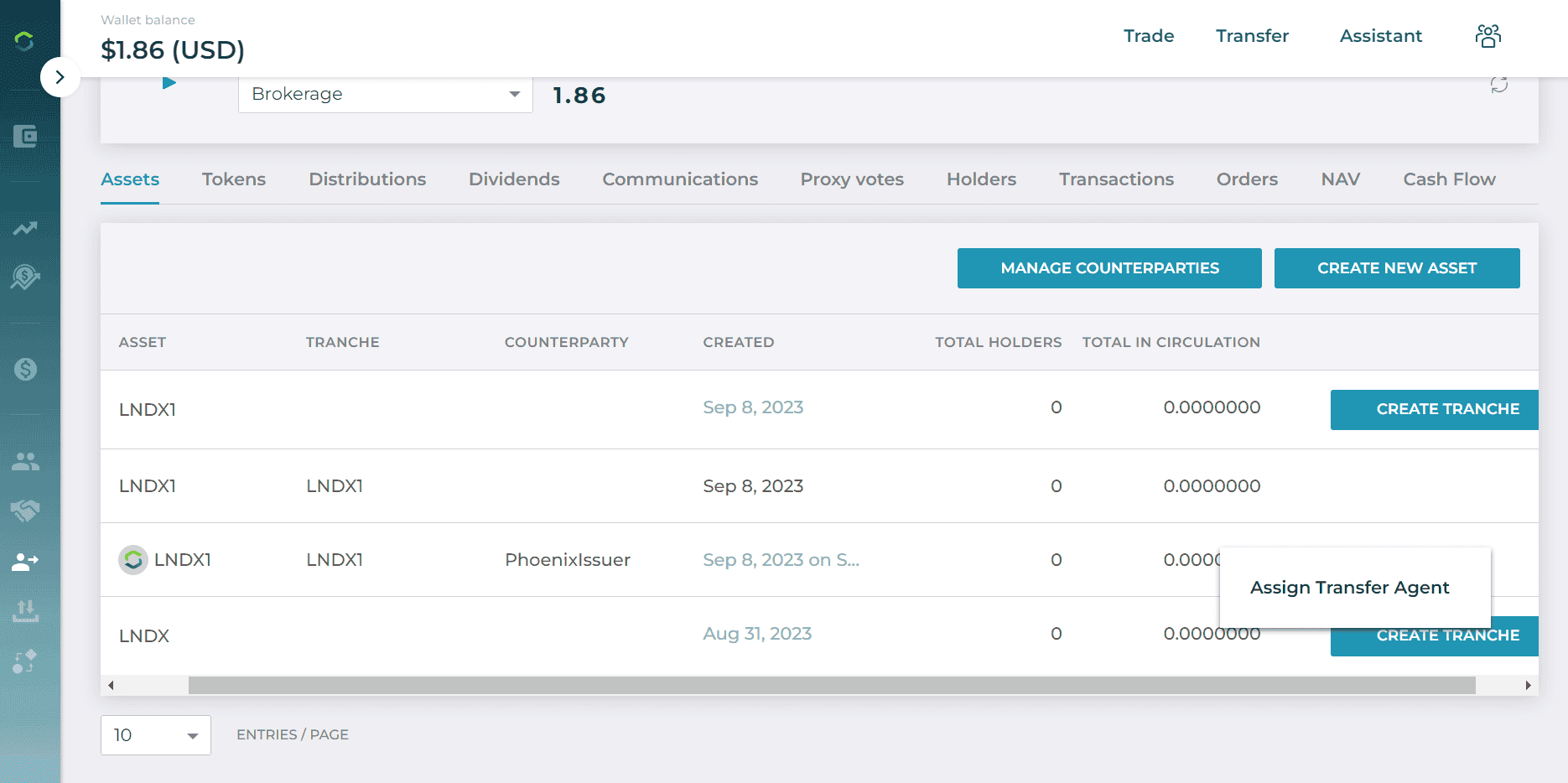

From the Assets tab, choose the Asset for which you want to issue Tokens. Click on the dropdown caret to view that Asset's available Tranches.

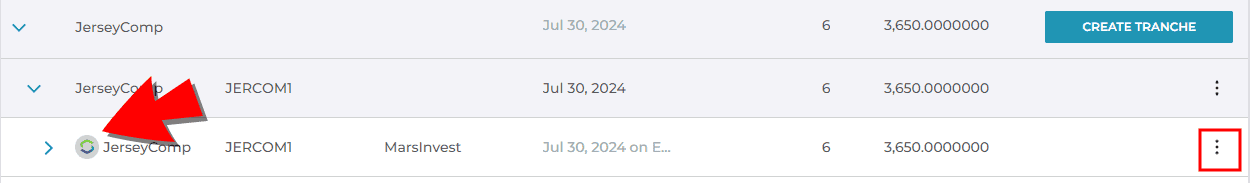

Select the vertical ellipses icon on the far right of the selected Tranche and click "Issue Token"

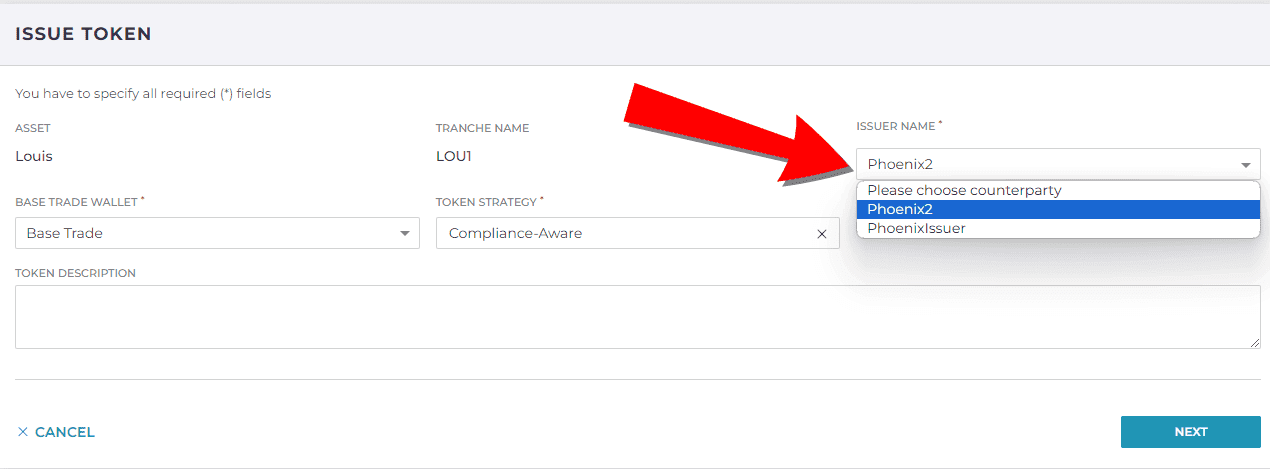

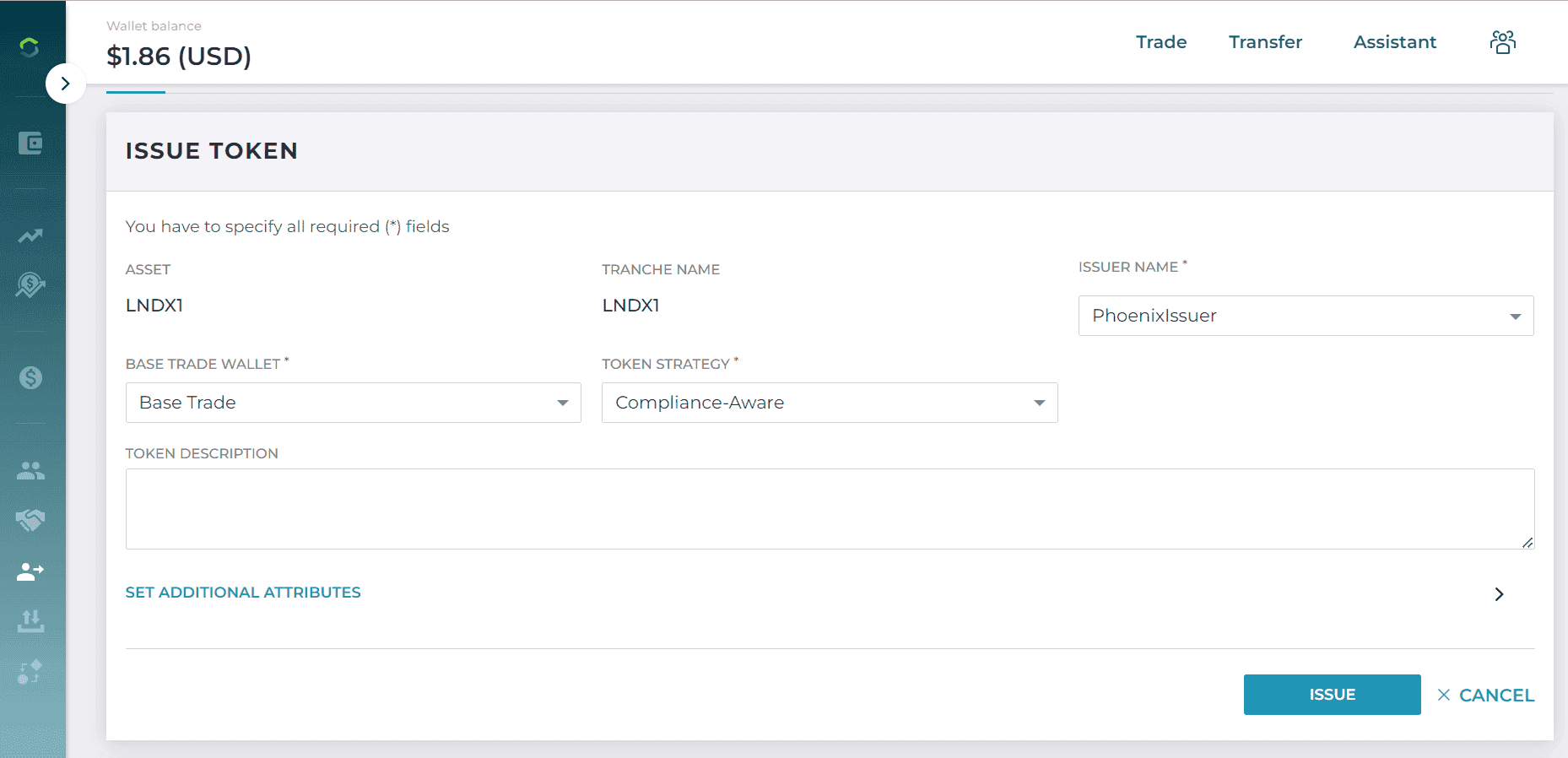

Select the Issuer Name from the dropdown. Note: The Issuer Name is derived from the available Counterparties. You must create a Counterparty for it to be available as a dropdown option.

Select the "Base Trade" option in the Base Trade Wallet dropdown. Then click the "Issue Token" Note: The network of the Base Trade Wallet determines the network of the token to be issued. In other words, if the Base Trade Wallet is on the Ethereum network, the token will be issued on the Ethereum network.

Note: You can disregard the options presented on the Set Additional Attributes screen. Scroll down to the bottom of the screen and select "Issue".

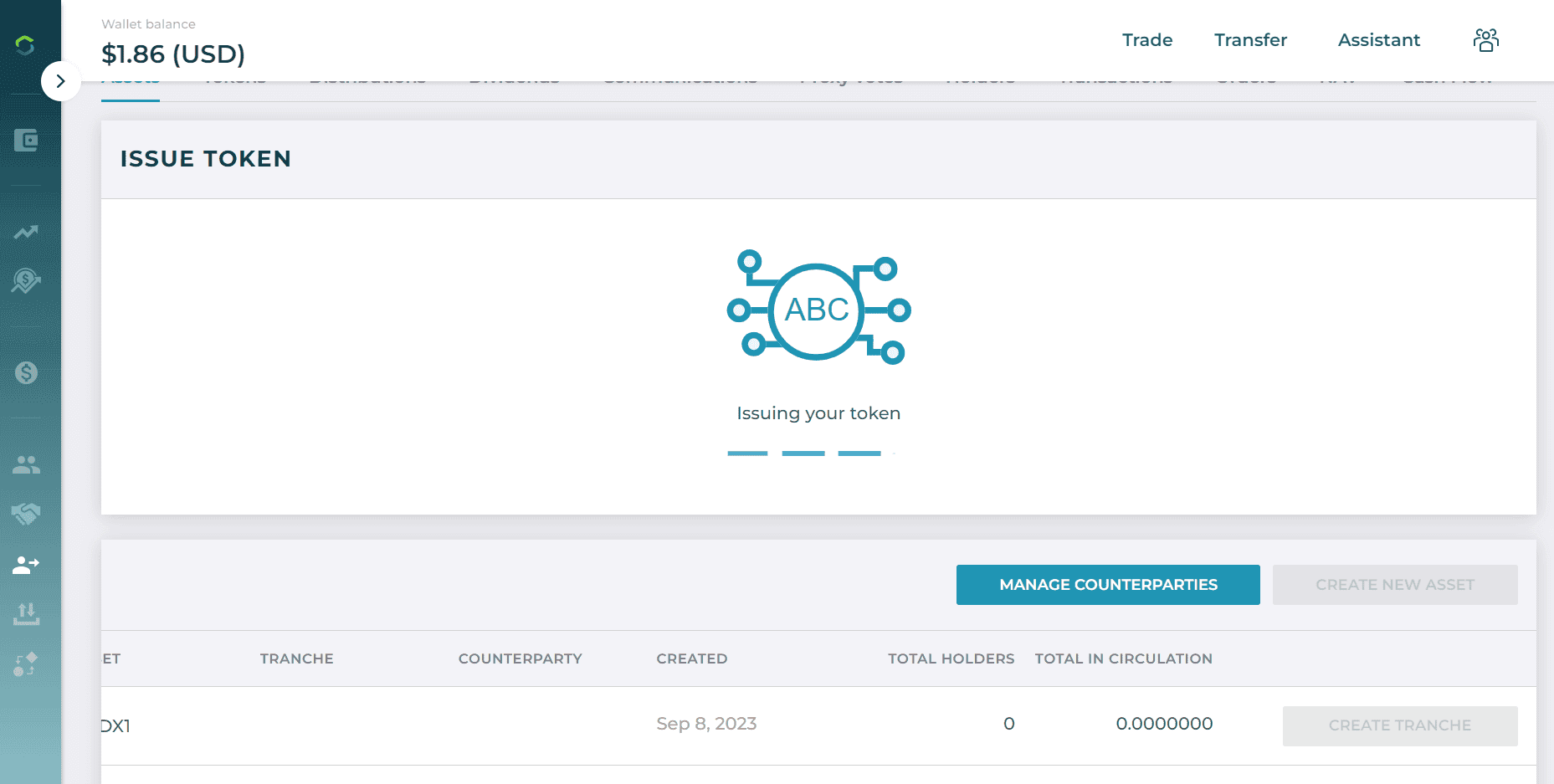

The Capital Markets Platform communicates with the Blockchain to issue the Token. Note: depending on your Internet speed and the traffic on the Blockchain, you may have to wait a few moments for the Token complete issuance.

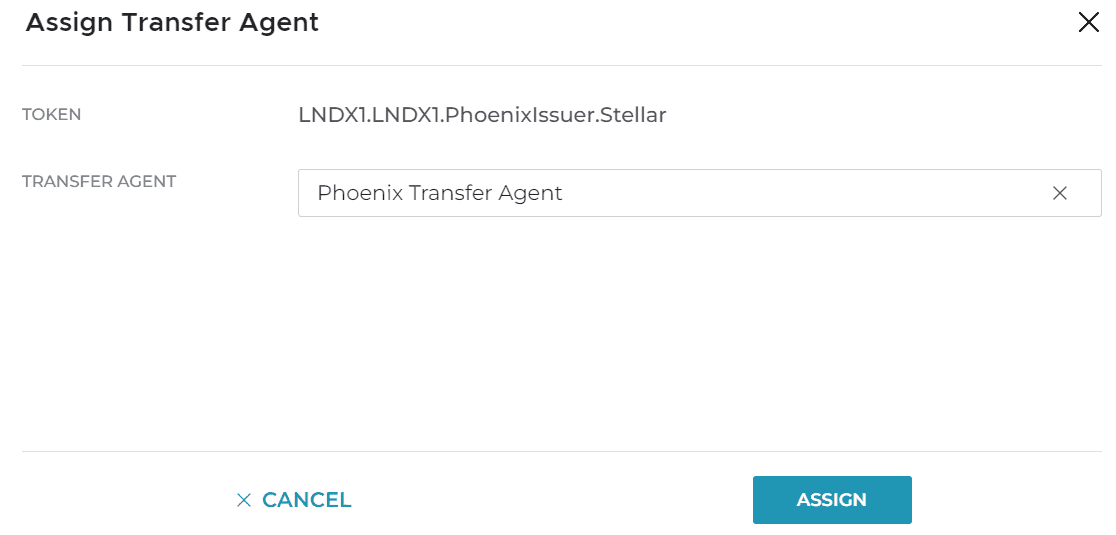

Assign Token to TA

Once you (an Investor) have successfully created a Token and assigned it to a Counterparty, you can assign Tokens to a Transfer Agent (TA).

Note: Only the Issuer profile can assign a Token to a Transfer Agent.

To assign a Token to a Transfer Agent:

From the home dashboard, select "Issue Token"

From the Assets tab, click the vertical ellipses icon of the Token that you want to assign and select "Assign Transfer Agent" Note: Use the downward caret to ensure you have drilled down to the Token, which are identified by the CMP icon

Select an Entity from the list of Departments. Click the "Assign" button. Then close the window.

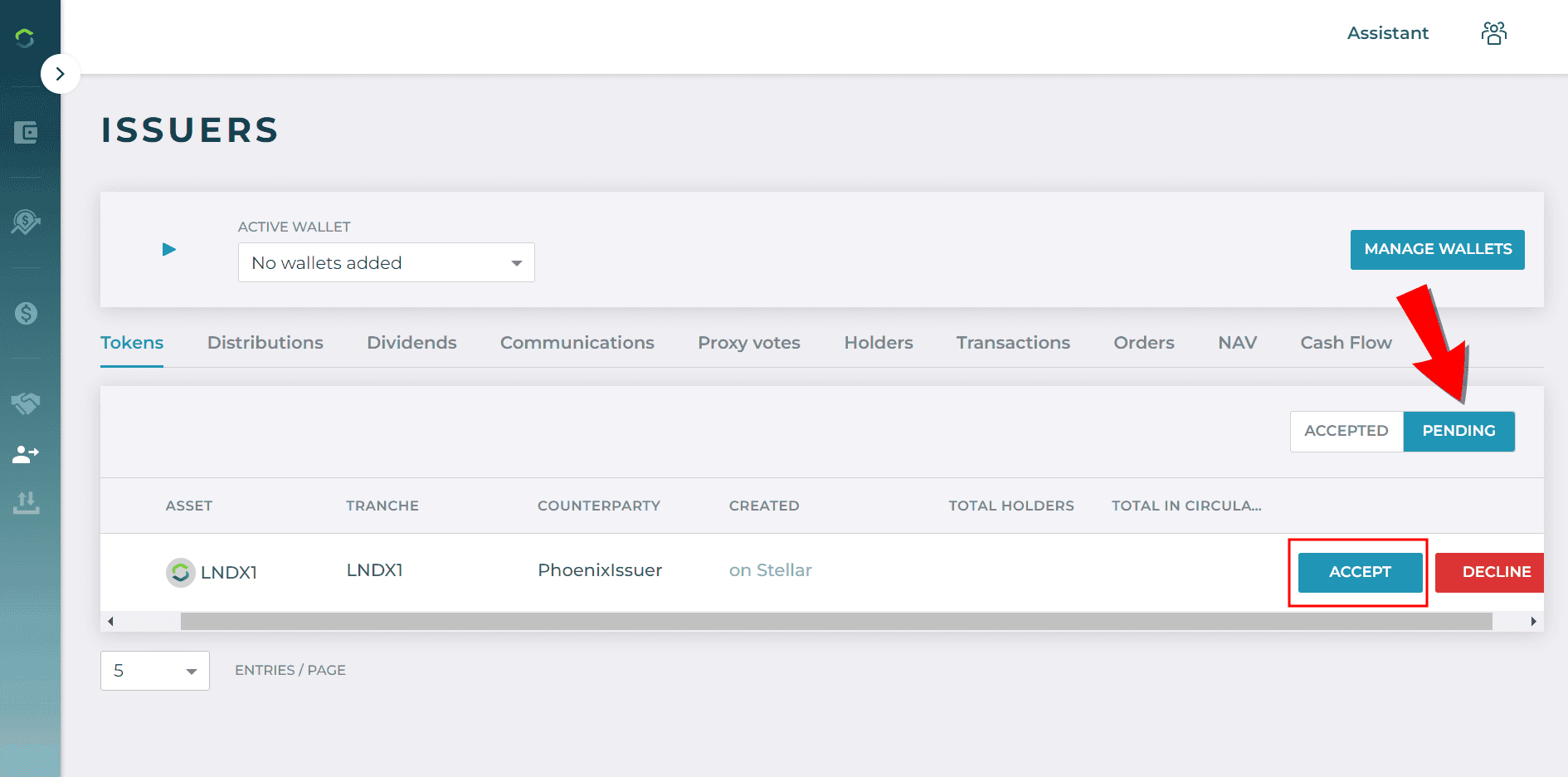

Accepting a Token as TA

This topic describes how a Transfer Agent accepts a Token assigned by an Investor persona.

Note: Only the Transfer Agent profile can accept a Token. This is due to the segregation of responsibilities built into the DTCC Capital Markets Platform.

From the home screen, select Issue Token tile

From the Issuers screen, filter by Pending, select the Token you wish to Accept

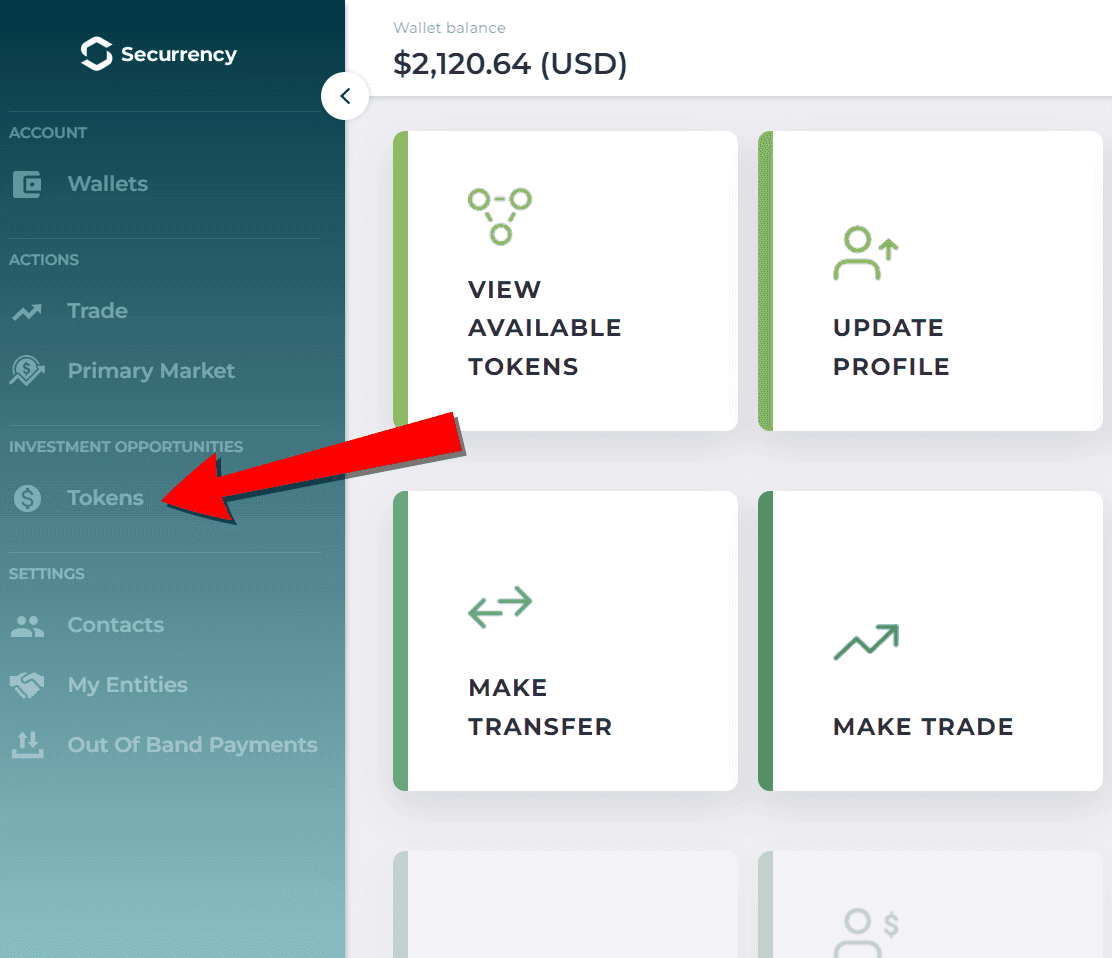

Set Trust Line

The Trust Line enables a Wallet to transact in a specific Token.

Note: Trust Lines are now only applicable to Stellar coins and any user persona can trust coins for themselves.

To set up a Trust Line for a specific Token:

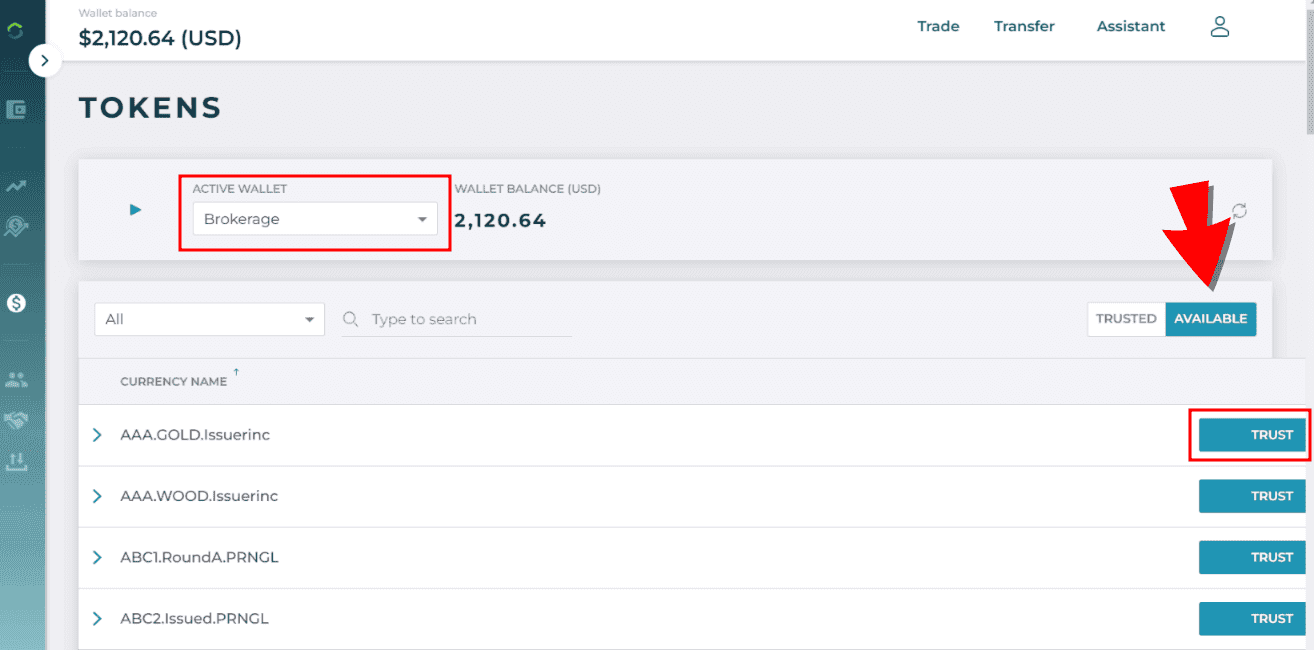

Select the Tokens tab in left-hand menu

Select the relevant Active Wallet from the dropdown. Select the Available tab and select the Token that you wish to set as a trusted and click "Trust".

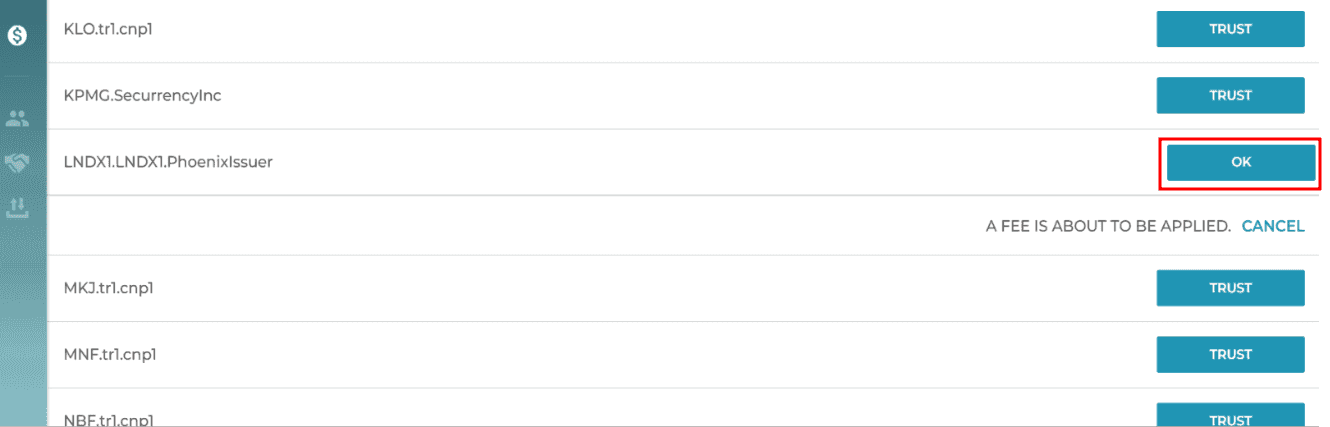

Click "OK" Note: the fee represents the network "gas fees" for the applicable Wallet.

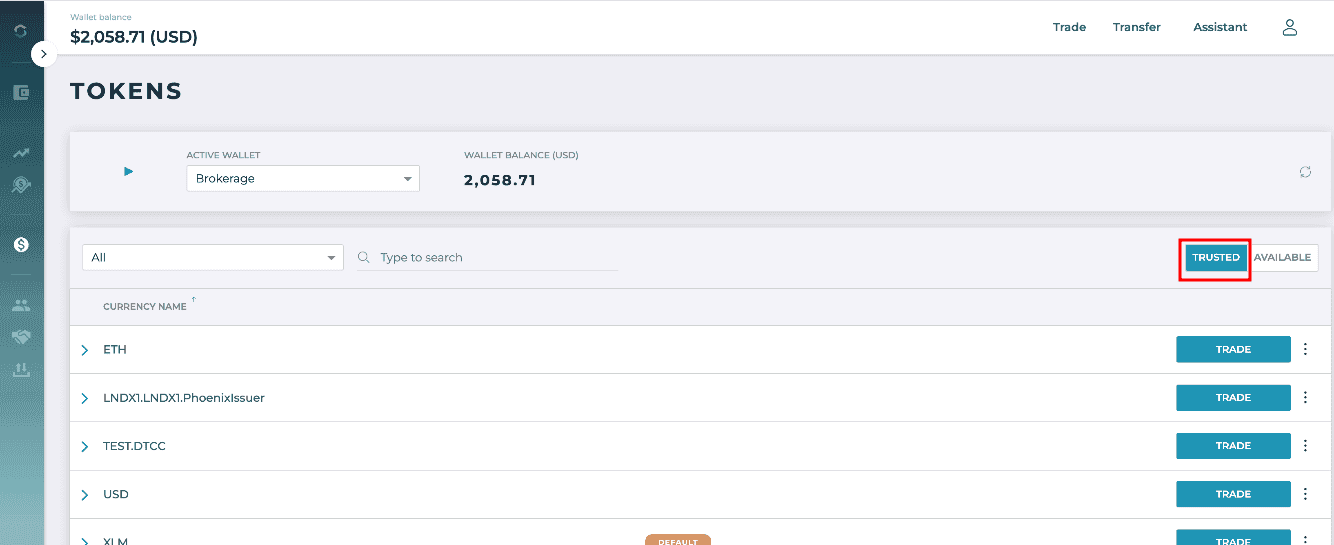

The Token now appears on the Trusted tab.

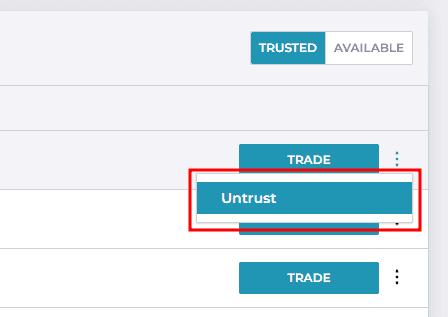

To remove a Token from the Trusted list, you can click the vertical ellipses icon and select "Untrust"